- FedWatch Tool forecasts 84.6% chance of rate cut in September.

- Bitcoin reacts with increased volatility and trading volume.

- Market anticipates possible adjustments in macroeconomic strategies.

The CME’s “FedWatch Tool” indicates an 84.6% probability of a 25 basis point rate cut by the Federal Reserve in September, significantly impacting market outlooks.

Market anticipation centers on how this potential rate cut could affect liquidity, potentially increasing trading volatility in cryptocurrency and other financial sectors.

84.6% Rate Cut Probability Shakes Crypto Market

CME’s “FedWatch Tool” reflects significant trading sentiment towards a rate cut by the Federal Reserve. This forecast is based on CME futures activity, with no direct statements from the Federal Reserve. Market focus has shifted as this data suggests potential adjustments in monetary policy.

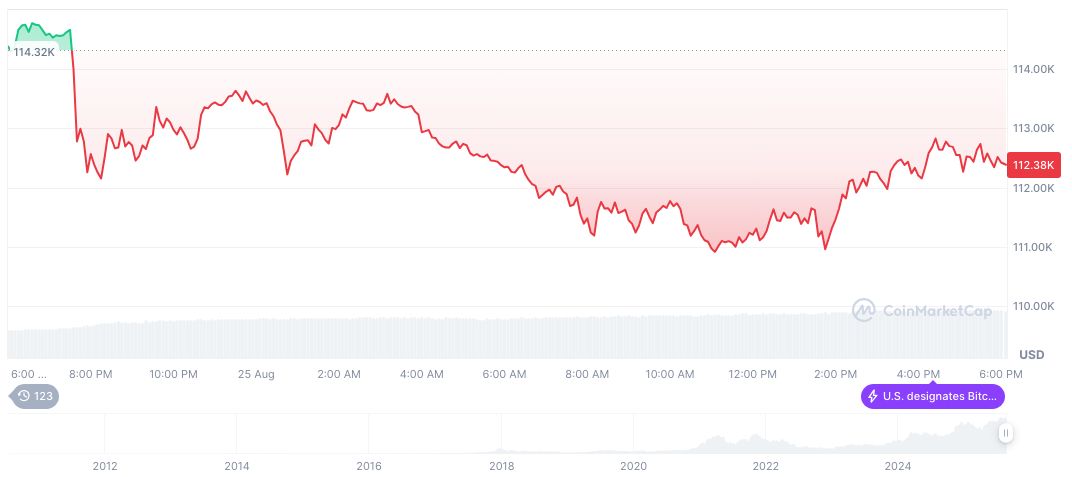

Bitcoin’s volatility has increased, with its price recently falling to $109,893.75. This marks a 3.09% decline over a 24-hour period, indicating market stress tied to Federal Reserve expectations. Larger moves are anticipated if the rate cut proceeds, impacting both crypto and traditional financial markets.

Significant reactions include increased activity among crypto whales, such as Huang Licheng, who has been notably accumulating Bitcoin. On-chain monitoring has observed significant purchases, with approximately 2,419 BTC acquired since July 18. This behavior suggests strategic positioning in anticipation of economic shifts.

Bitcoin’s Volatility and Historical Insights Amid Fed Speculations

Did you know? Historically, Bitcoin has demonstrated increased volatility ahead of Federal Reserve policy changes, with past rate cuts often preceding bullish market trends.

CoinMarketCap reports Bitcoin’s current price at $109,893.75, with a market cap of $2.19 trillion and 24-hour trading volume at $89.74 billion, noting an 18.44% trading volume increase. Historically, Bitcoin has shown resilience despite short-term declines of 3.09% in the last 24 hours.

Experts from Coincu suggest close observation of the Fed’s decision is crucial for market strategy. Historical trends highlight tactical market responses, with cryptocurrencies exhibiting marked volatility responsive to rate changes. Deciphering regulatory developments could reveal new investment pathways amidst uncertain macroeconomic forecasts. “Trump’s firing of Powell is fundamentally blatant, being a blatant extortion and an attempt to pressure policymakers to cut rates,” noted Nick Timiraos, Chief Economics Correspondent at The Wall Street Journal.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cut-impacts-bitcoin/