- Powell remains steadfast despite Trump’s pressure to lower rates.

- Federal Reserve faces heightened political influence concerns.

- Markets and digital assets experience increased volatility.

Nick Timiraos of the Wall Street Journal described former President Trump’s moves against Federal Reserve Chair Jerome Powell as a blatant attempt to influence monetary policy.

The struggle highlights potential threats to central bank independence, sparking investor concerns about USD stability, impacting Treasury yields and major digital currencies like Bitcoin and Ethereum.

Trump’s Federal Reserve Pressure Stirs Market Turmoil

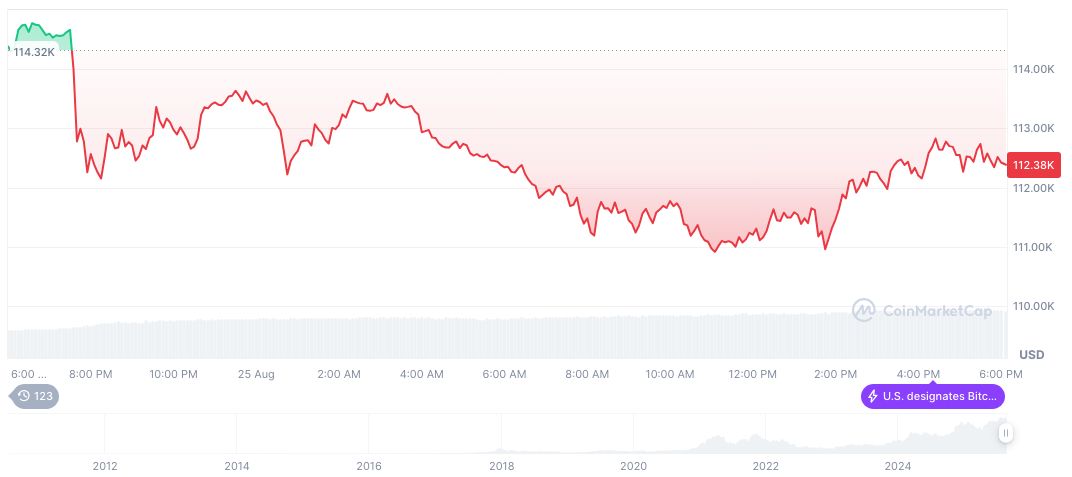

The market witnessed immediate reactions, with major digital assets like Bitcoin and Ethereum experiencing volatility. Jerome Powell’s steadfast stance drew significant industry attention. Market analysts anticipate ongoing turbulence, highlighting Trump’s attempts to pressure Powell publicly. Main cryptocurrencies BTC and ETH showed renewed volatility, reflecting investor uncertainty.

Jerome Powell, Chairman, Federal Reserve, “My answer would be ‘no’ when asked if he would resign if fired by the President, adding, ‘The law clearly gives me a four-year term, and I fully intend to serve it.’

Jerome Powell, Chairman, Federal Reserve, “My answer would be ‘no’ when asked if he would resign if fired by the President, adding, ‘The law clearly gives me a four-year term, and I fully intend to serve it.’

Bitcoin and Ethereum Volatility Amid Political Tensions

Did you know? In 2019, Trump’s pressure on Powell led to increased volatility in U.S. Treasury yields, influencing both traditional and digital markets.

Bitcoin (BTC) experiences significant volatility amid the ongoing political influence over the Federal Reserve. As of August 26, 2025, its price stands at $108,901.05, as reported by CoinMarketCap. The market cap is valued at $2.17 trillion, with a 24-hour trading volume reaching $86.02 billion. Recent volatile movements include a 3.42% decline in the past day and a 6.70% drop over the last week. BTC’s market dominance is 57.74%.

Coincu research team suggests continued political tension over Fed independence could impact traditional and digital markets. Price stability and rate expectations may face challenges, influencing risk-on/risk-off sentiment and integration of digital assets like BTC and ETH into broader economic systems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-powell-fed-market-impact/