Key Takeaways

Solana is closing in on a $100 billion market cap, setting up a direct showdown with Binance Coin. Can SOL flip BNB this cycle?

Solana [SOL] has ripped 14.65% this month, reclaiming the $100 billion market cap it lost earlier this year. Basically, SOL added nearly $10 billion in market value from its $172 base.

Meanwhile, Binance Coin [BNB] has only nudged up 9%. Still, hitting a historic $120 billion market cap and $900 per coin. Bottom line: SOL still needs roughly a 20% market cap increase to match BNB this cycle.

On a bullish note, the SOL/BNB ratio is closing August up 4.5% from a 0.21 base.

That’s SOL’s first bullish month versus BNB since May, showing that it is starting to flex relative strength and pick up momentum on-chain.

Source: TradingView (SOL/BNB)

In short, writing off a flip isn’t too far-fetched.

Technically, Solana would need about a 20% lift to tag BNB, putting the per-SOL target around $234 from $195. That’s a solid move, and the setup for a real run is starting to line up.

Still, it won’t be easy. BNB has slammed back-to-back ATHs, most recently $900 on the 22nd of August, lining up with SOL’s $210 resistance test. In turn, setting the stage for a proper showdown through the rest of Q3.

Is Binance Coin gaming Solana’s market cap?

Solana tagged $115 billion but couldn’t hold, sparking speculation.

SOL pulled back nearly 5% from its $213 high, wiping out around $10 billion intraday, as chatter ramped that BNB might be leaning on Wintermute to cap Solana and defend its market cap.

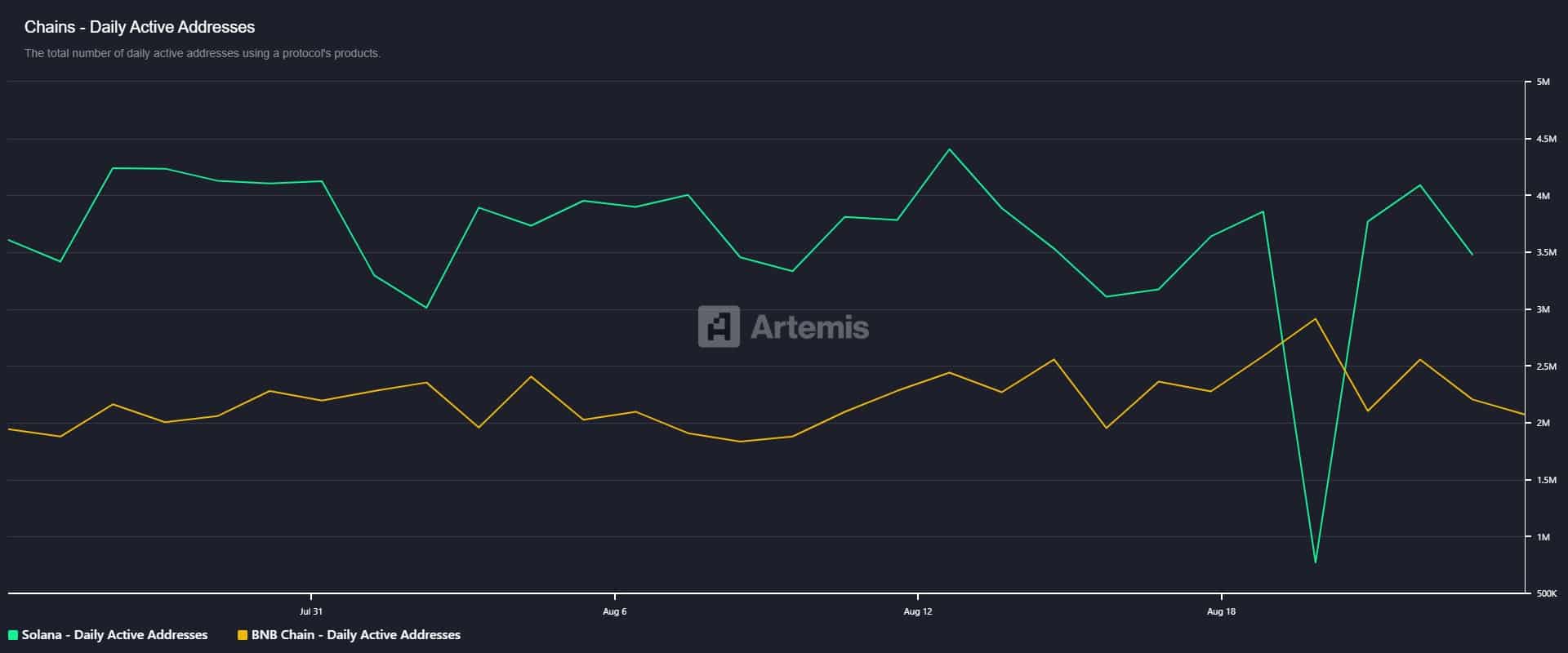

Even if “alleged,” the SOL/BNB ratio slipped 3%, signaling relative weakness and liquidity rotation toward BNB. On-chain, daily active addresses are +7% on BSC versus -3% on Solana, reinforcing the trend.

Source: Artemis Terminal

And the divergence runs deeper.

Across other metrics, Binance Chain is flexing monthly outperformance, even though BNB only pumped 9% versus SOL’s 14% over the same period. That puts BNB’s ATHs more than a fluke.

Bottom line: The suppression theory doesn’t hold. Solana still has a long road to flip BNB, both on-chain and technically, leaving BNB as the stronger play heading into Q3 and Q4.

Source: https://ambcrypto.com/solana-looks-to-flip-bnb-in-q4-but-binance-wont-give-up-easily/