Speaking at the WebX Asia conference, BitMEX co-founder Arthur Hayes made a big revelation, expecting 126x upside for the Hyperliquid token, HYPE. Hayes believes that the native cryptocurrency could significantly benefit from the explosive growth in the decentralized exchange’s (DEX) revenue. HYPE price shot up 5% earlier today, despite the broader crypto market correction.

Arthur Hayes Projects 126x Upside for Hyperliquid (HYPE) Token

Former BitMEX CEO Arthur Hayes predicts a mega bull case for the HYPE token, driven by the expanding stablecoin market and the platform’s growing market share. According to Hayes’ analysis presented at the WebX Asia conference, Hyperliquid is positioned to capture significant value as the stablecoin market expands.

His projections show the global stablecoin supply reaching $10 trillion by 2028, with Hyperliquid capturing a 26.4% share of the associated trading volume. This comes as the decentralized exchange (DEX) saw its Assets Under Management (AUM) recently crossing $6.2 billion. Hayes believes that this expansion will drive annualized revenues from the current $1.2 billion to $258 billion by 2028.

In his recent analysis, Hayes applied a 5% discount rate to calculate the terminal value of HYPE token revenues at $5.161 trillion. Thus, with a fully diluted valuation (FDV) at $41.05 billion, this creates what Hayes describes as a 126x upside potential for early investors.

The 126x upside projection represents one of the most bullish forecasts for a DeFi protocol token. The recent forecast is much higher than $100 target for the HYPE token, which Arthur Hayes gave earlier this year.

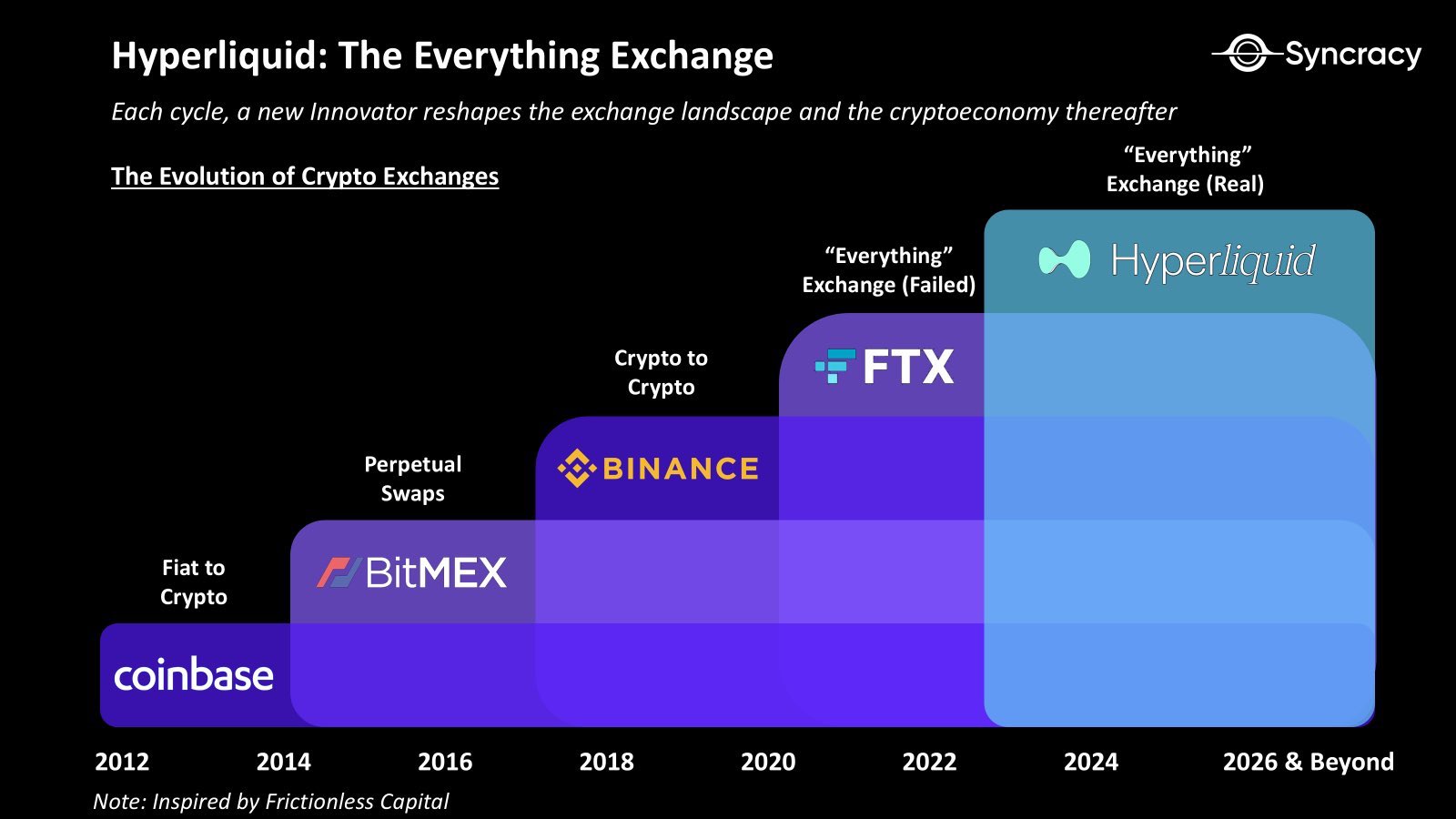

Overtaking Giants Like Coinbase and Bybit

Decentralized exchange (DEX) Hyperliquid is challenging some of the biggest industry players like Coinbase and Bybit. The DEX is gaining traction as an “everything” exchange, serving across different industry participants. Ryan Watkins, the co-founder of Syncracy Capital said: “Just now, BTC spot on Hyperliquid did more 24H volume than Coinbase and Bybit combined.”

Hyperliquid is rapidly emerging as a leading exchange for spot trading of BTC, ETH, and SOL. In recent days, the platform has seen significant activity, particularly around Unit/Hyperliquid, with all operations running seamlessly.

Large-scale transactions, including nine-figure BTC deposits and substantial ETH withdrawals, were completed within minutes on its decentralized infrastructure. Notably, Hyperliquid’s BTC spot market has just recorded a 24-hour trading volume surpassing the combined totals of Coinbase and Bybit. Amid this strong trading activity, regulated players like USDC stablecoin issuer Circle, are also moving their assets on the decentralized exchange.

From the April lows, the HPYE price has rallied by a massive 300%, and is currently trading at $45. The altcoin already ranks among the top 15 crypto assets by market cap. As per the HYPE price prediction, the altcoin is eyeing for potential upside following the recent consolidation. The daily trading volume is up by 78% to $278 million, suggesting strong bullish sentiment among traders.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/arthur-hayes-gives-126x-upside-potential-for-hyperliquid-at-a-massive-5-trillion-fdv/