Key Takeaways

SPX6900 rallied 12.38% to $1.5 before significantly dropping to $1.39 at press time. Whales offloaded 1.16 million tokens, while retail traders continued to accumulate.

SPX6900 [SPX] soared 12.38% reaching a local high of $1.510 before significantly retracing to $1.39 at press time.

Over the same period, the memecoin’s trading volume surged 124.9% to $83 million, while market cap bounced to $1.4 billion.

Typically, when volume and market cap rise alongside each other, it reflects growing capital participation and steady capital inflow.

SPX: Retail buyers step in

After SPX6900 declined to $1.2, small-scale investors jumped into the market to buy the dip. As a result, retailers boosted the memecoin’s demand, thus driving prices up with it.

Source: CoinGlass

According to CoinGlass, SPX6900 has recorded a negative Spot Netflow for six consecutive days.

On the 23rd of August, the memecoin’s Netflow declined to -$1.16 million, signaling higher exchange outflow compared to inflows.

When Netflow turns negative, it implies a higher buying pressure on exchanges, which is often a prelude to higher prices.

Whales are extremely bearish

Surprisingly, as prices recovered from the recent dip, SPX6900 whales turned to profit realization. According to Nansen, whales offloaded 1.16 million SPX tokens and only acquired 397.7k tokens.

Source: Nansen

As a result, the top holders’ Balance Change turned negative, reaching a low of -795k. When Balance Change is negative, it signals a higher outflow relative to inflow, a clear aggressive selling signal.

Derivatives bet against SPX

Despite the price uptick, most market participants rushed to bet against the market, per derivatives data.

Source: CoinGlass

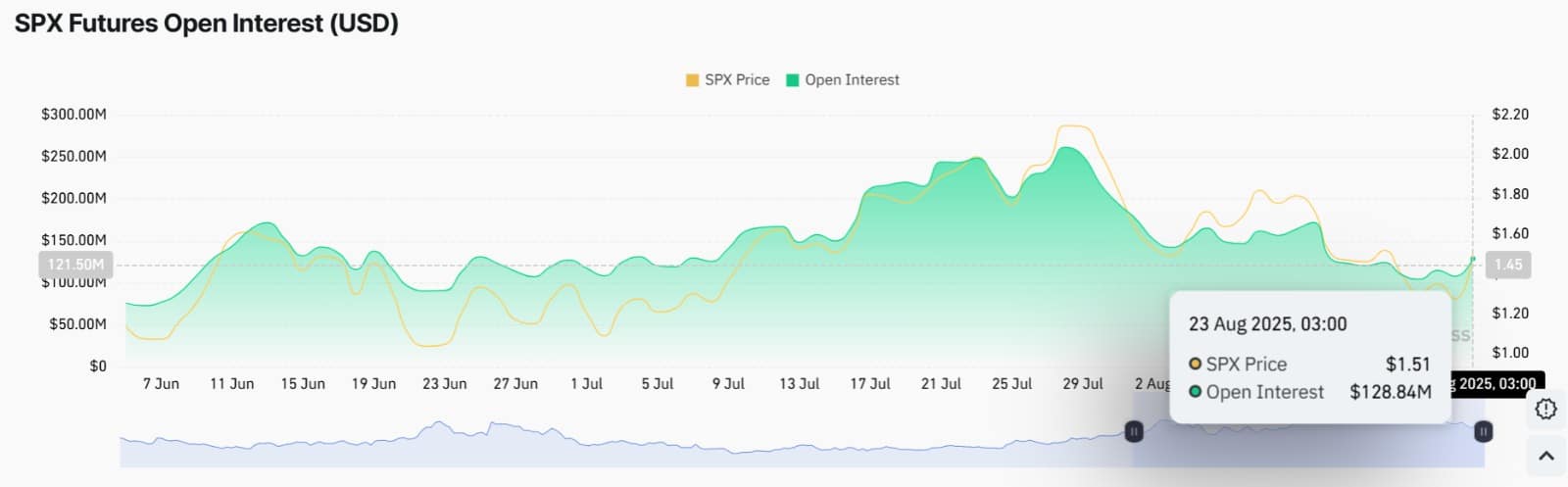

According to CoinGlass, SPX’s Derivatives Volume jumped 166.6% to $291 million, while Open Interest surged 12% to $128 million.

Often, when these two metrics rise together, it signals increased participation and capital influx into the Futures market.

Source: CoinGlass

Meanwhile, the Long/Short Ratio declined to 0.843, with shorts accounting for 54% and longs for 45.7% of total Futures contracts.

This demand for shorts is more prevalent on Binance, with the ratio dropping to 0.57 and 0.63 for top trader long-short accounts.

When shorts dominate Futures, it suggests that participants are bearish and actively betting for a price drop.

Short-lived uptrend?

According to AMBCrypto’s analysis, SPX rebounded as retail traders jumped into the market to buy the dip.

At the same time, the memecoin retraced significantly as whales turned to cash out while derivatives remained bearish.

As a result, the memecoin’s Relative Strength Index (RSI) made a bearish crossover, dropping from 46 to 43 at press time. Likewise, its MACD declined to -0.091, further confirming weak buying pressure.

Source: TradingView

When these momentum indicators are in such a manner, it signals faint upward momentum, with weak hands dominating that market.

That said, if the prevailing conditions hold, especially with whales offloading, SPX6900 will likely drop to $1.21.

However, if market sentiment from large entities shifts while retailers hold on, SPX will reclaim $1.5 and target $1.7 resistance.

Source: https://ambcrypto.com/spx6900-surges-12-but-spxs-latest-rally-looks-short-lived-why/