- Stablecoins hold nearly $200 billion in U.S. Treasury bonds.

- They are now the 17th largest holders of U.S. Treasury bonds globally.

- Stablecoin reserve allocations are shifting towards U.S. Treasuries.

Bitwise Asset Management reports that, as of March 31, stablecoin issuers hold nearly $200 billion in U.S. Treasury bonds, ranking 17th globally.

This reflects strategic diversification amidst regulatory pressures, boosting Treasury demand and affecting stablecoin market dynamics.

Stablecoins Emergent as Major U.S. Treasury Bond Holders

U.S. Treasury bonds held by stablecoins are now slightly under $200 billion, according to Bitwise Asset Management’s data. This substantial figure recently emerged from routine financial disclosures, elevating stablecoins to the 17th largest holders of these assets. With this update, Bitwise’s systematic methodology, traditionally used for crypto index weights, sheds light on how reserve requirements influence market capabilities.

Stablecoin issuers have increasingly shifted their reserve allocations towards U.S. Treasuries. New reserve proposals, like the GENIUS Act, emphasize investment in short-duration T-bills. This has ignited demand within both government and private sectors seeking asset security. Stablecoin circulation doubling over 18 months has significantly raised Total Value Locked (TVL) in DeFi, with potential for faster growth.

Market analysts observe no significant public comments from crypto industry leaders or regulatory figures in response to Bitwise’s findings. However, regulatory bodies continue enforcing stablecoin compliance in financial markets. Developers and community members focus on enhancing yield-bearing strategies over short-term reactions, underscoring confidence in long-term strategies.

Regulatory Adaptations and Strategic Financial Shifts

Did you know? The 2025 increase in stablecoins’ U.S. Treasury holdings echoes strategic financial shifts seen in 2022, marking parallels to previous regulatory challenges and liquidity trends.

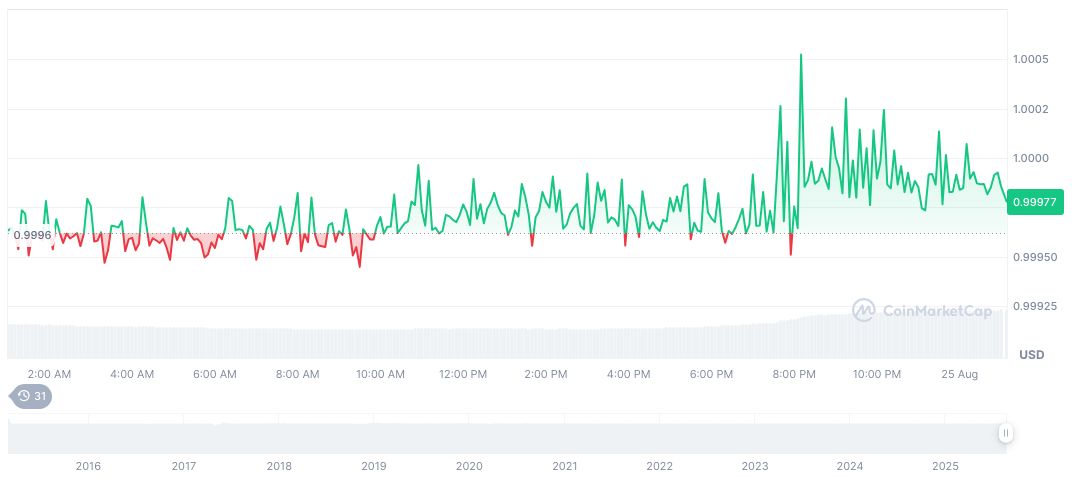

Tether USDt (USDT) maintains a price of $1.00, with a market cap of approximately $167.12 billion, accounting for a 4.27% market dominance, according to CoinMarketCap. Despite a substantial 24-hour trading volume increase (40.89%), it sees minimal short-term price variations, indicating stable market positioning.

Regulatory landscapes continue to evolve, with potential impacts on stablecoins’ financial strategies in mind. Insights from Coincu suggest ongoing adaptability will be crucial for navigating broader regulatory changes, leveraging data-driven trends for sustained stability. Expert analysis underscores a dedication to regulatory compliance as critical for maintaining market vitality and trust.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/stablecoins-us-treasury-holdings-2025/