- Hong Kong aligns with Basel crypto standards, impacting Bitcoin and stablecoins.

- Regulations start January 1, 2026.

- Affects banks’ crypto asset holding policies.

The Hong Kong Monetary Authority confirmed the full implementation of crypto regulations aligned with Basel standards from January 1, 2026, impacting cryptocurrency handling by banks.

This shift may influence Hong Kong banks’ strategies in managing stablecoins and other digital assets, raising attention across the banking and crypto sectors.

Hong Kong’s Basel Alignment Set for January 2026

The HKMA has confirmed the adoption of Basel Committee crypto standards, covering Bitcoin, Ethereum, and real-world assets (RWA) as of 2026. Approved by relevant authorities, these standards establish how banks must manage, report, and evaluate crypto assets. The rules encompass risk management protocols for both on-balance-sheet holdings and third-party custodial services.

This initiative addresses critical risk management factors linked to how banks manage and report these assets. It aims to enhance transparency while maintaining separation between bank and client assets. Industry insiders comment on potential shifts in market sentiment, particularly in the acceptance of stablecoins and RWA tokens by financial entities. Although official public reactions are sparse, relevant stakeholders are closely monitoring impacts.

Our goal is to establish a robust regulatory environment for cryptocurrency that aligns with global standards, ensuring stability and innovation in Hong Kong’s financial sector. — Eddie Yue, Chief Executive, HKMA

Managing Crypto Risks and Market Sentiment Shifts

Did you know? Basel standards, once implemented in Switzerland, led banks to minimize direct crypto assets on balance sheets but boosted service infrastructure—a trend experts anticipate in Hong Kong.

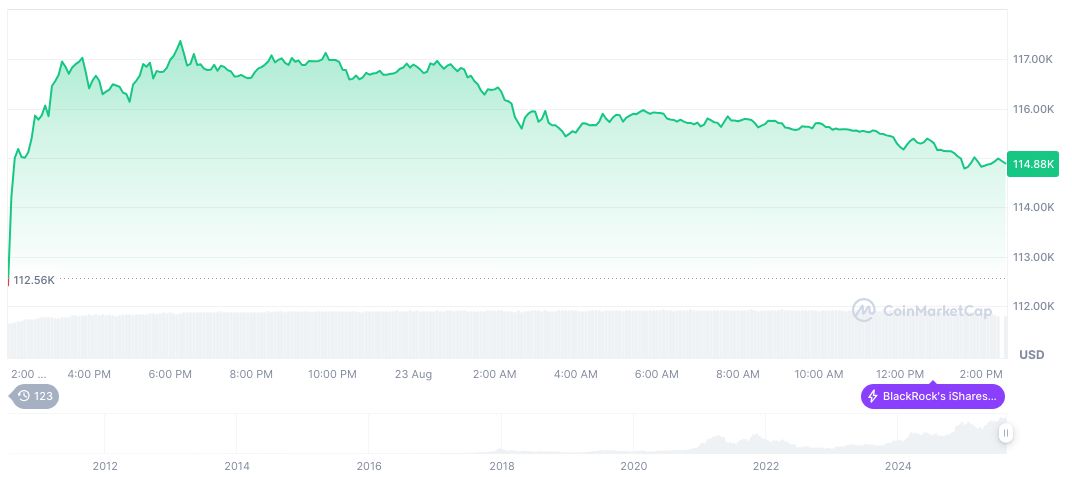

As of August 24, 2025, Bitcoin (BTC) is priced at $114,624.35, with a market cap of approximately $2.28 trillion, dominating 57.63% of the crypto market. The 24-hour trading volume stands at $53.31 billion, facing a 35.62% decrease. BTC’s price has fluctuated, showing a 7.05% increase over 60 days. Data sourced from CoinMarketCap.

The Singapore Exchange has launched a Bitcoin perpetual that could further influence financial markets

Crypto payments company MESH has raised $82 million to expand their operations, reflecting market growth in the sector

The Cayman Islands requires VASP licenses for crypto firms now, highlighting regulatory changes in various global regions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-basel-crypto-2026/