- Japan’s FSA proposes cryptocurrency tax reclassification by 2026.

- New legal status for cryptocurrencies under financial law.

- Potential boost for market with crypto ETFs introduction.

Japan’s Financial Services Agency (FSA) aims to redefine cryptocurrencies as financial products by 2026, offering a 20% flat tax, aligning them with stocks and bonds.

This significant regulatory shift is poised to enhance market stability and attract institutional investments, as Japan moves closer to integrating cryptocurrencies into its financial framework.

Japan’s FSA Proposes Crypto as Financial Product by 2026

Japan’s Financial Services Agency (FSA) plans a significant shift in cryptocurrency regulation by 2026. This move aims to reclassify digital assets as financial products, aligning them with the Financial Instruments and Exchange Act. The initiative will introduce a flat 20% capital gains tax instead of the existing progressive rates that can reach up to 55%. Furthermore, the reforms include extending insider trading regulations and disclosure requirements to digital assets, effectively enhancing investor protection.

The proposed changes are expected to make the market more attractive to institutional investors. This move may also ease the launch of crypto exchange-traded funds (ETFs) in Japan, granting regulated funds and retirement plans access to cryptocurrency markets. The shift to a 20% tax bracket aligns digital currencies with traditional financial products like stocks and bonds, potentially increasing market confidence and adoption.

“The proposed changes will align cryptocurrencies with regulations for stocks and other traditional financial instruments. The entity also revealed that it will amend the Financial Instruments and Exchange Act to implement the changes.” — FSA Official Statement, Financial Services Agency, Government of Japan

While the proposal has generated interest from market observers, no official statements from key industry leaders or companies have been recorded. Some expectations revolve around increased market stability, aligned with Japan’s ongoing “New Capitalism” initiative. Future announcements and specific guidelines from regulators will be anticipated by investors and market participants.

Bitcoin Dominance and Expert Views on Japan’s Strategy

Did you know? Japan’s cryptocurrency reforms echo its 2017 Bitcoin legalization, again placing the nation at the forefront of integrating digital assets into the financial mainstream.

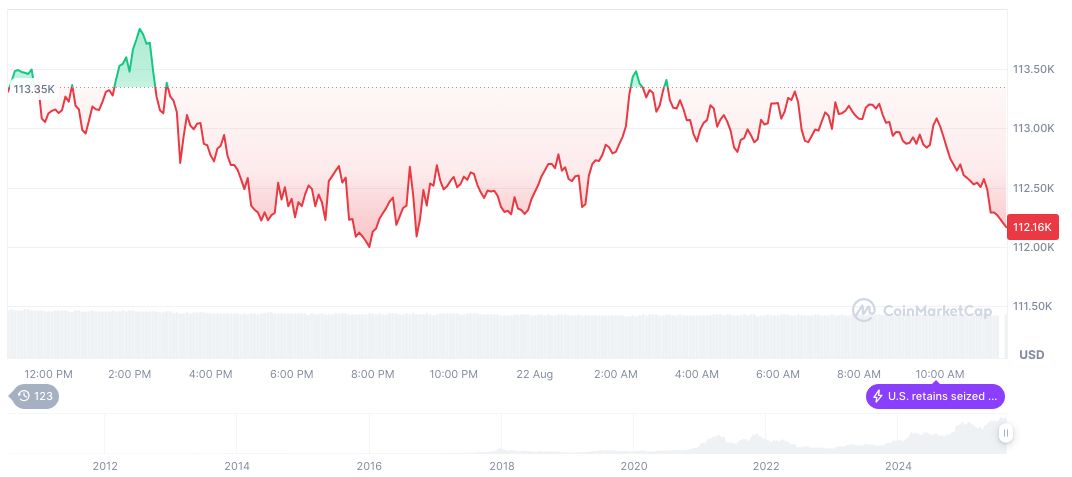

According to CoinMarketCap, Bitcoin (BTC) recently traded at $115,765.81 with a market cap of approximately 2.30 trillion, capturing 57.66% dominance. The 24-hour trading volume reached $83.63 billion, showing a 42.01% increase. Bitcoin’s price changed by 2.38% in the last 24 hours, falling by 1.62% over the past week. Recent trends note a 10.26% increase over 60 days, with no dramatic liquidity or trading events linked to the FSA proposal.

Experts from Coincu suggest the proposed FSA reform could significantly strengthen Japan’s financial ecosystem. By fostering crypto stability and supporting ETFs, the initiative may boost both domestic and international investments. This regulatory alignment has the potential to position Japan as a global leader in cryptocurrency regulation, influencing markets worldwide.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/japan-reclassifies-crypto-2026/