- Unexpected dual Fed rate cut forecast from Deutsche Bank stirs markets.

- Bitcoin spikes, surpassing $117,000 in reaction.

- Regulatory focus shifts, with SEC roundtables on cryptocurrency policy.

Deutsche Bank anticipates a 25 basis points rate cut by the Federal Reserve in September and December 2025, according to BlockBeats News on August 22.

This possible adjustment could influence financial strategies, yet lacks confirmation from Deutsche Bank or the Federal Reserve, signaling cautious market interpretations.

Fed’s Monetary Easing Potentially Bolsters Crypto Sentiment

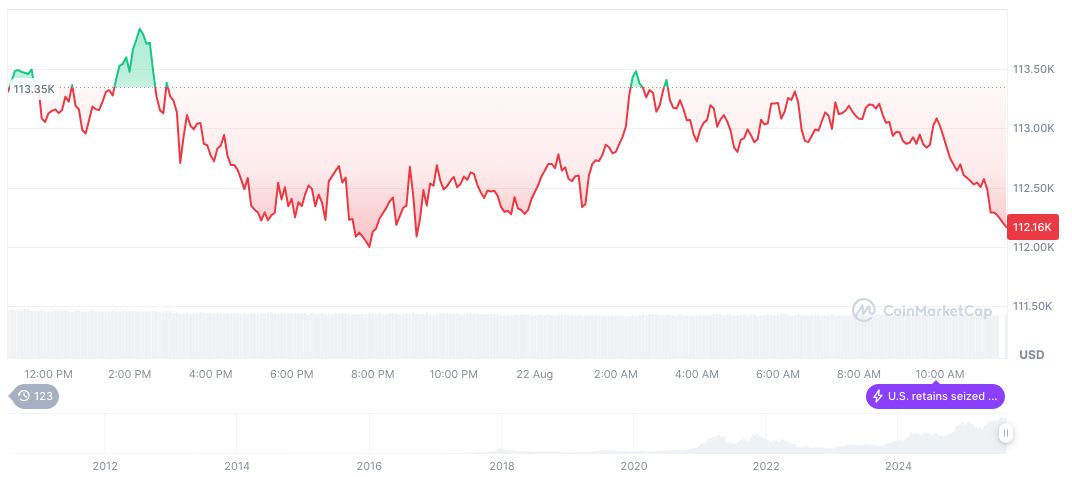

Bitcoin’s recent rise has been significant, climbing to $116,721.61, representing a 3.82% increase over the past 24 hours, according to CoinMarketCap. The digital asset’s 24-hour trading volume swelled by 38.24%, reaching $81.32 billion, as investors reacted to economic forecasts. Despite short-term gains, Bitcoin showed a 0.81% decrease over the past week. With a current market cap of $2.32 trillion and a dominance of 57.62%, Bitcoin remains a pivotal force in the digital economy.

Coincu research analysts suggest that the potential Fed rate cuts could bolster risk sentiment in the cryptocurrency market. Historical analysis shows economies often experience growth in risk assets, such as cryptocurrencies, during periods of monetary easing. Such actions could amplify market volatility, fostering both opportunities and challenges.

It appears that there are no confirmed quotes or statements from Deutsche Bank or other relevant financial authorities regarding the expected future actions of the Federal Reserve, specifically concerning potential rate cuts in September and December 2025.

Market Reactions and Future Outlook

Did you know? Economies often experience growth in risk assets, such as cryptocurrencies, during periods of monetary easing.

Bitcoin’s market performance and trading volume have shown significant fluctuations, indicating a responsive market to macroeconomic changes.

Analysts believe that the current economic climate may lead to further volatility in cryptocurrency markets, making it essential for investors to stay informed and agile.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/deutsche-bank-fed-rate-cuts-impact/