- Bitcoin mining companies boost market share to 32.5% in Q2 2025.

- Growth led by Marathon, Canaan, Iris, and CleanSpark.

- Key leaders emphasize sustainable growth in market.

Listed and emerging Bitcoin mining companies have increased their market share to 32.5% in the second quarter, driven predominantly by Marathon, Canaan, Iris Energy, and CleanSpark.

This shift marks a strategic shift in Bitcoin mining, reflecting increased consolidation among major players, impacting hash power distribution and potential concerns over mining centralization.

Major Players Expand Market Share to 32.5% in Q2 2025

Bitcoin mining consolidation efforts have led to a notable increase in the market share of public mining companies from 21.1% in the previous year to 32.5% in Q2 2025. Marathon Digital Holdings, Canaan Inc., Iris Energy, and CleanSpark spearheaded this growth. These companies have significantly increased their hash power, offsetting declines from other miners.

MARA, Canaan, Iris Energy, and CleanSpark have emphasized their strategic focus on expanding hash power. Marathon Digital Holdings is notably enhancing its facilities to maintain its competitive edge. Canaan Inc. and Iris Energy are prioritizing sustainable and efficient operations. This focus on operational efficiency translates into increased productivity and market presence.

Patrick Witt, Acting Executive Director of the White House Crypto Council, stated that “maintaining fair access to energy” for Bitcoin mining is crucial, as the sector grows more professionalized. Key industry leaders advocate for sustained and responsible expansion, amidst regulatory considerations.

Fred Thiel, CEO of Marathon Digital Holdings, remarked, “We’re seeing strong momentum in our hash growth. This market consolidation reflects our long-term vision to secure Bitcoin’s network while maintaining operational efficiency.”

Analysis: Regulatory Scrutiny and Future Innovations

Did you know? During 2021-2022, similar consolidation phases saw public miners increase their market share, which eventually stabilized as more competitors entered the space, minimizing centralization risks.

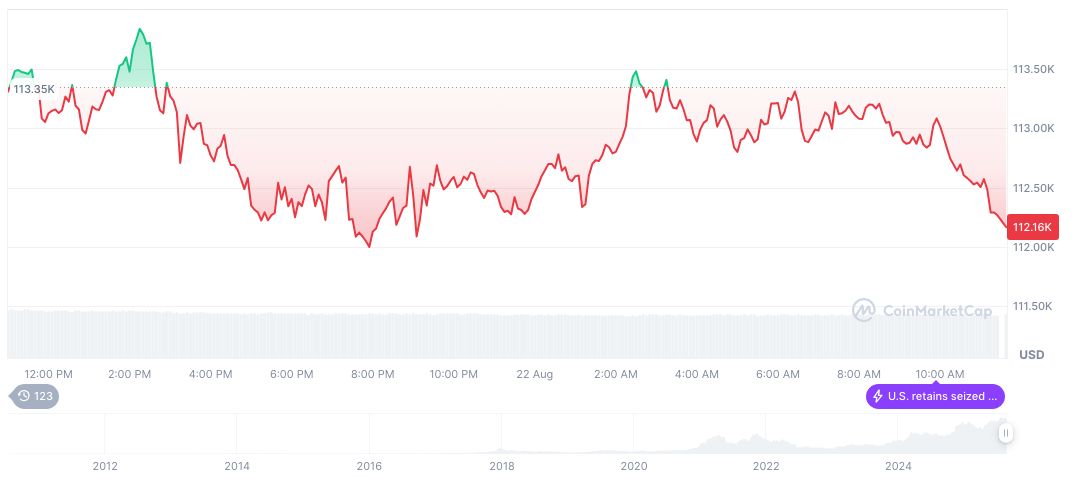

According to CoinMarketCap data, Bitcoin’s market cap is $2.33 trillion, with a dominance of 57.61%. In recent 90-day analysis, BTC’s price increased by 7.23%. The 24-hour trading volume reached $81.07 billion, fluctuating by 35.46% in recent data.

The Coincu research team suggests that the increase in market concentration might lead to heightened regulatory scrutiny. Long-term effects on technological innovation are anticipated, as companies invest in sustainable practices. Maintaining efficiency can optimize mining operations, influencing future adjustments in the crypto-economic ecosystem.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/bitcoin-mining-market-share-growth/