- Fitch retains U.S.’s ‘AA+’ rating; economic size and global currency status underpin stability.

- Rising fiscal deficits challenge long-term outlook despite current ratings stability.

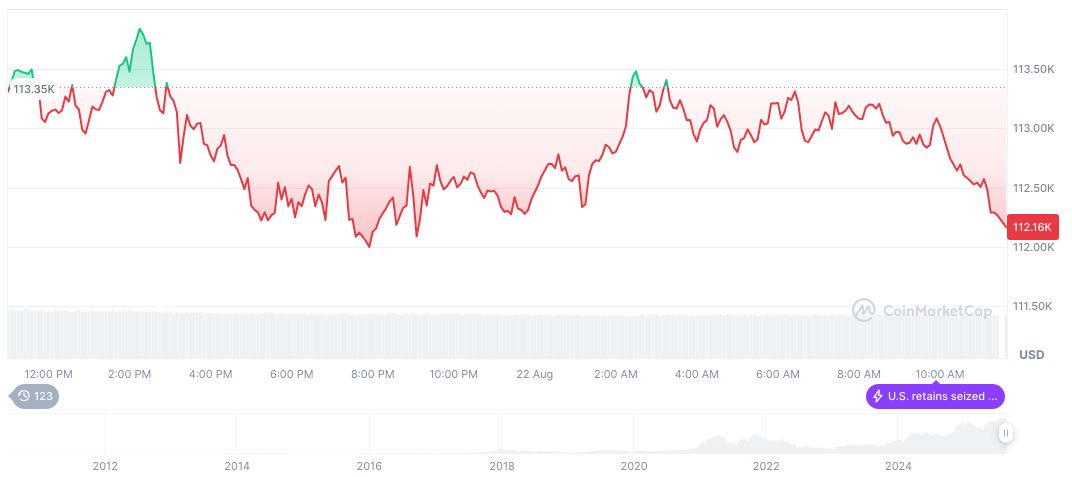

- Crypto markets show no substantial shifts from this affirmation event.

Fitch Ratings reaffirmed the United States’ ‘AA+’ credit rating with a stable outlook on August 22, 2025, citing economic strengths and fiscal challenges.

This affirmation maintains market stability, highlighting ongoing fiscal risks potentially impacting sovereign debt markets and related financial instruments, including dollar-backed stablecoins.

U.S. Retains Second-Highest Credit Rating Amid Deficits

Fitch Ratings has confirmed the U.S.’s ‘AA+’ rating, emphasizing the economic scale, income per capita, and the U.S. dollar’s status as the global reserve currency. Despite high deficits and debt levels, the U.S. retains stable financing conditions. Fitch projects a mixed fiscal outlook, with deficits initially decreasing before rising by 2027.

Maintaining the ‘AA+’ rating secures the U.S.’s access to low-cost capital. However, fiscal constraints demand careful management of upcoming borrowing costs. While specific market reactions remain subdued, the rating reaffirmation keeps existing financial arrangements intact. As quoted by Fitch, “Fitch Ratings has affirmed the United States of America’s Long-Term Foreign Currency Issuer Default Rating (IDR) at ‘AA+’ with a Stable Outlook” [Fitch].

No major public statements have emerged from key figures in response to the rating. Fitch’s official rationale focused on the U.S.’s financial resilience, with no immediate shifts in fiscal policy as of now.

Historical Rating Downgrades and their Market Effects

Did you know? In 2011, the U.S. saw a rating downgrade from S&P, prompting a notable rise in Bitcoin and gold prices, showcasing a historical correlation between credit ratings and safe-haven asset movements.

According to CoinMarketCap, Bitcoin (BTC) is trading at $116,625.66, with a 24-hour change of 3.98%. The market cap is approximately $2.32 trillion, with a dominance of 57.58%. The last 90 days have seen BTC gain 7.08%.

Research from Coincu suggests that fiscal challenges could eventually influence regulatory and financial strategies. The emphasis on debt management reflects potential changes in treasury policies. Long-term, technological investments may counteract demographic-induced fiscal strains, bolstering economic prospects.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/us-rating-aa-plus-fitch-update/