- Federal Reserve remarks influence market trends; crypto prices experience volatility.

- Bitcoin and Ethereum face pricing pressure amid economic signals.

- BNB sees growth, potentially due to institutional interest.

Bloomberg economist Anna Wong analyzed Federal Reserve Chair Jerome Powell’s August 23 remarks, highlighting a nuanced stance that could impact macroeconomic trends and crypto markets.

Powell’s ambiguous messaging is causing market uncertainty, with declines in BTC and ETH reflecting potential crypto reactions to perceived hawkish sentiments.

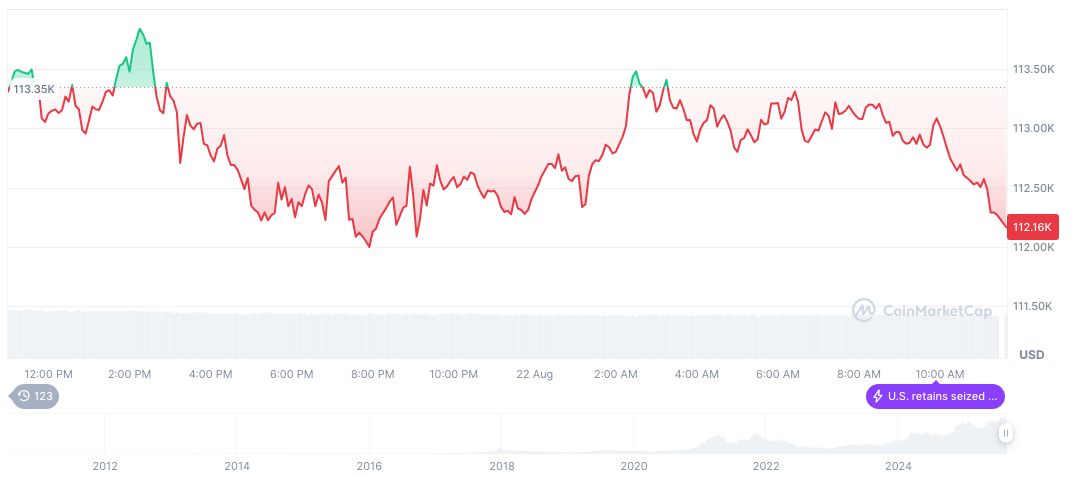

Jerome Powell’s Comments Cause Bitcoin and Ethereum Price Drops

Federal Reserve Chair Jerome Powell’s recent comments have been met with keen interest from various markets. Anna Wong, Chief U.S. Economist at Bloomberg, described Powell’s statement as “not dovish,” predicting that the clarity in his comments will become evident over time. Wong noted the market’s tendency to react and later reverse its stance, resulting in short-term volatility.

Bitcoin’s price decline sparked various reactions from industry leaders, though no official statements were made. Experts are especially watching how these developments play into broader economic concerns, as they could signal shifts in investor sentiment across both traditional and digital financial landscapes.

Arthur Hayes, Co-founder of BitMEX, stated that the market volatility following Fed announcements highlights the sensitivity of crypto assets to macroeconomic signals; this is a pattern we’ve seen before.

Current Bitcoin Metrics and Future Regulatory Speculations

Did you know? Historical trends indicate that ambiguous Federal Reserve statements often lead to initial market spikes followed by reversals. This pattern impacts both traditional and crypto assets like Bitcoin and Ethereum.

According to CoinMarketCap, Bitcoin is currently priced at $116,501.70, with a market cap of $2.32 trillion. Its 24-hour trading volume reached $76.82 billion, reflecting a 3.35% price increase. Despite recent fluctuations, Bitcoin’s dominance over the cryptocurrency market remains at 57.87%.

Coincu researchers predict macroeconomic tensions might continue to exert pressure across crypto markets. Potential regulatory changes, especially those affecting liquidity, could further influence investor strategy and blockchain adoption. Observers will keenly watch any official statements on these fronts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-comments-impact-crypto/