- U.S. stock index futures show V-shaped recovery on August 22, 2025.

- No direct primary-source commentaries reference this move.

- Crypto-exposed equities report significant activity and volatility.

On August 22, 2025, U.S. stock market futures exhibited a notable “V-shaped” recovery, with the Dow Jones, S&P 500, and Nasdaq 100 futures all turning positive.

This shift signals potential investor confidence and may influence related cryptocurrency markets, including notable crypto-exposed equities like BNB Treasury Company and recently delisted Windtree Therapeutics.

U.S. Futures Surge with Crypto-Equities Activity

Cathie Wood, CEO of Ark Invest, amplified the market’s momentum by reallocating shares within the Robinhood platform, investing approximately $16.22 million. She stated, “Ark Invest added a total of 150,908 shares of Robinhood stock yesterday, which is approximately worth $16.22 million based on the closing price.”

Market reactions varied across sectors. President Trump criticized Federal Reserve policy, claiming it hindered mortgage procurement—a notable external commentary amid the recovery. He remarked, “Can someone please tell Jerome ‘Too Late’ Powell that his actions are severely damaging the real estate industry? People are unable to get mortgages because of him.”

Mixed Reactions Amid Federal Policy Criticism

Did you know? V-shaped recoveries in U.S. stock markets often correlate with key economic announcements, impacting crypto-equities.

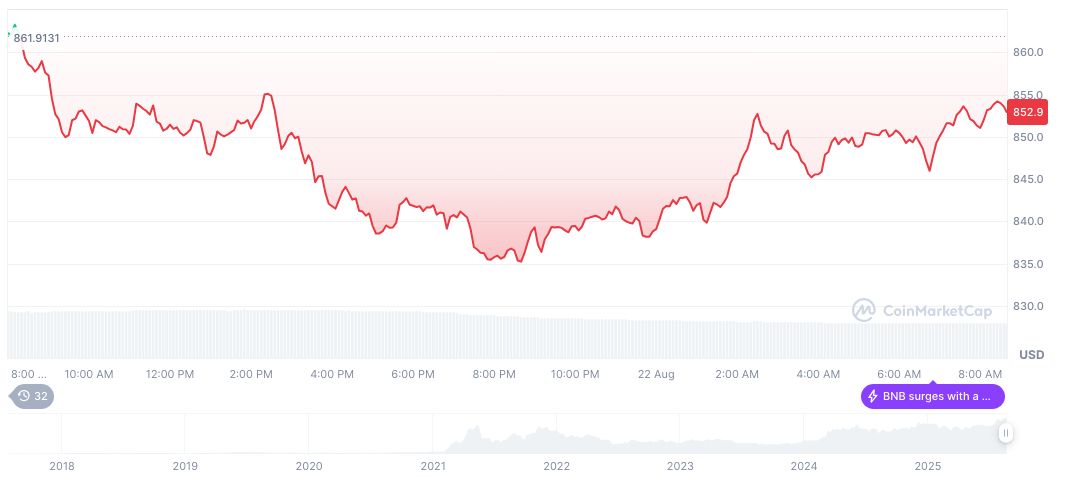

BNB’s market snapshot highlights a recent price of $853.57, supported by a circulating supply of 139,287,464.16 according to CoinMarketCap. The token’s market cap is noted at $118.89 billion, with current dominance at 3.09%. Trading volume decreased by 23.46% over 24 hours.

Coincu’s research team anticipates significant regulatory deliberations around crypto-exposed equities soon, especially given historical volatilities observed during similar index movements. Accurate data connectivity from market analytics forms the basis of these assessments, underscoring potential trends that could shape market outlooks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-stock-index-futures-v-recovery-crypto-volatility/