- CME predicts a 75% chance of a September rate cut by the Federal Reserve.

- Speculation affects both traditional financial and cryptocurrency markets.

- No official statements are available from the Federal Reserve or CME.

CME’s FedWatch Tool indicates a 75% probability of a 25 basis point rate cut by the Federal Reserve in September, intensifying market speculation as of August 22, 2025.

Such rate changes typically influence cryptocurrency volatility and liquidity, with potential impacts on BTC and ETH prices pending official announcements.

CME Tool Signals 75% Chance of September Rate Cut

CME’s FedWatch Tool suggests a 75% chance of a rate cut by the Federal Reserve in September 2025. The speculation around a Federal Reserve rate cut in September is affecting market expectations, with significant attention from financial sectors and cryptocurrency enthusiasts alike. The CME FedWatch Tool indicates a 75% likelihood of a 25 basis point rate cut occurring in September, based on market sentiment and economic data. As traders and analysts closely monitor these updates, anticipation grows regarding the outcome of the upcoming Federal Open Market Committee (FOMC) meeting. There are no official statements from the Federal Reserve or CME providing further insight into these projections.

The absence of primary commentary from institutions such as the Federal Reserve poses challenges. Speculation continues despite market volatility amid these expectations, and cryptocurrency markets remix cautiously. Without confirmation from official sources, uncertainty looms among crypto traders and traditional investors alike. Market analysts are probing for any signals from the Federal Reserve that could confirm or dismiss this rate outlook. Meanwhile, the broader financial community awaits any further official guidance. Market reactions have been muted, with cryptocurrency prices showing relative stability despite these speculations.

If the Fed cuts rates in September as expected, you can bet crypto will catch a bid as liquidity seeps back into risk assets,” said Arthur Hayes, Co-Founder, BitMEX.

Impact on Crypto as Bitcoin Declines Amid Speculation

Did you know? A rate cut by the Federal Reserve historically promotes market growth for cryptocurrencies like Bitcoin and Ethereum.

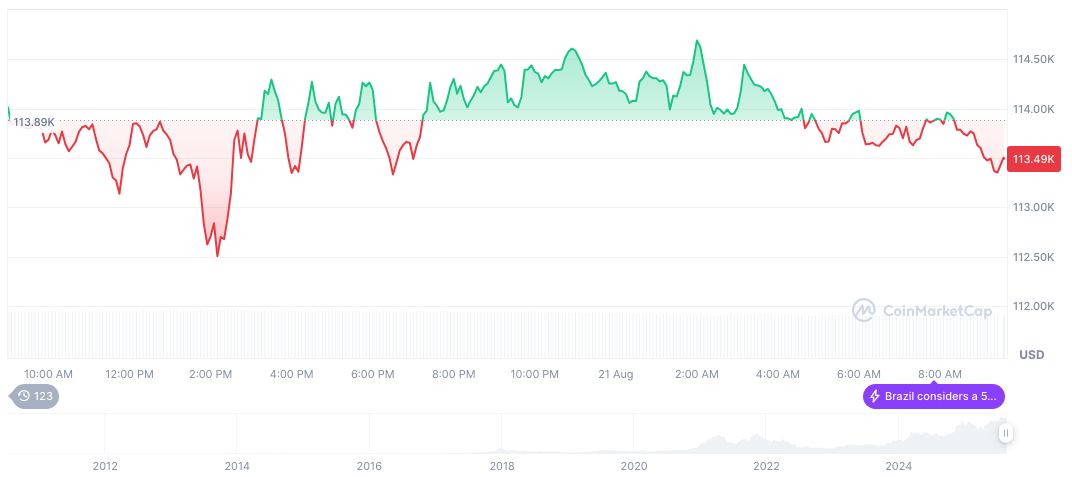

CoinMarketCap data reveals Bitcoin (BTC) trading at $112,766.37 with a market cap of $2.25 trillion. The cryptocurrency shows a 24-hour decline of -1.27%, reflecting guarded market sentiment. Recent trends indicate a mixed performance: a 7-day fall of -4.61% and a modest 60-day gain of 12.09%. Last updated on August 22, 2025.

The Coincu research team underscores potential widespread financial ramifications linked to Federal Reserve decisions. A rate cut may trigger liquidity inflow into risk assets, historically promoting market growth for cryptocurrencies like Bitcoin and Ethereum.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-september-rate-cut-2/