- Federal Reserve’s potential interest rate cuts amid economic uncertainty.

- Impacts on U.S. Dollar Index, Bitcoin (BTC), and Ethereum (ETH) prices.

- Historically, dovish signals have resulted in positive trends for cryptocurrencies.

Federal Reserve Bank of Boston President Susan Collins indicated on August 22 that a short-term rate cut could be considered if the U.S. labor market outlook worsens.

This potential rate cut highlights the Federal Reserve’s readiness to navigate economic uncertainties, potentially boosting risk assets, including cryptocurrencies like Bitcoin and Ethereum, amidst ongoing elevated inflation concerns.

Key Developments, Impact, and Reactions

Susan Collins, speaking at a Boston event, emphasized the need for potential short-term rate adjustments to address labor market deterioration. While inflation persists, the Fed remains open to easing monetary policy preemptively. Her comments have prompted discussions due to the Fed’s cautious approach, weighing ongoing inflation against economic uncertainty.

In line with Collins’ comments, the Federal Reserve has shown a capability to pivot monetary stances. Market stakeholders observe USD’s dip, driven partly by the anticipation of rate cuts, affecting holdings like BTC and ETH. Her call for flexibility in monetary approaches aligns with historical patterns, where interest rate cuts led to increased liquidity and investor confidence in risk assets.

“If the U.S. labor market outlook deteriorates, a short-term rate cut may be warranted, even if inflation remains above target.” – Susan M. Collins, President & CEO, Federal Reserve Bank of Boston

Crypto Market Awaits Fed Decision; Historical Data Shows Positive Trends

Did you know? Historically, dovish Fed signals have boosted BTC and ETH prices, particularly during 2019-2020 rate cuts, marking significant uptrends.

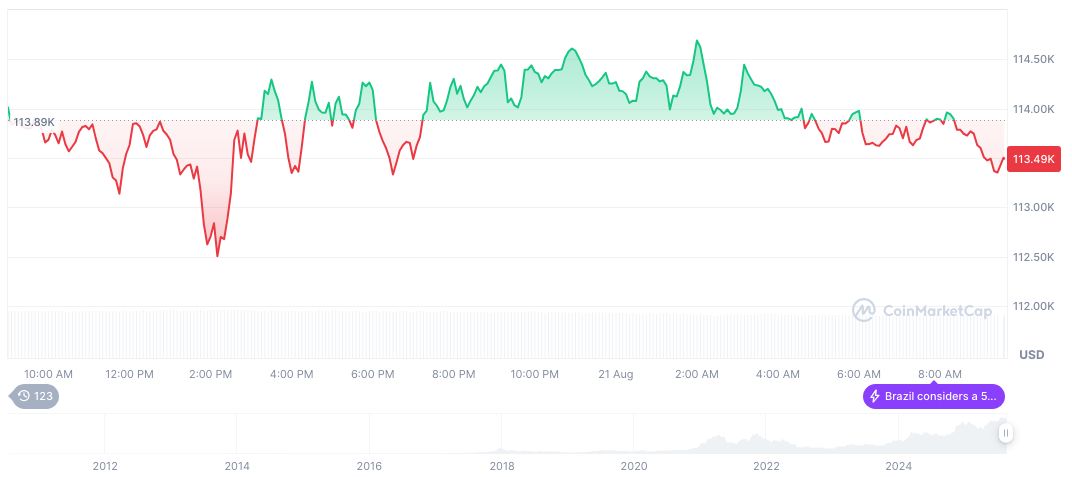

According to CoinMarketCap, Bitcoin (BTC) is priced at $112,451.35 with a market cap of $2.24 trillion. Its recent performance indicates a 1.83% drop over the last 24 hours, though it remains 11.45% higher over 60 days. The 24-hour trading volume stands at $58.84 billion, having decreased by 16.27%.

Coincu research suggests that potential rate cuts could further stimulate risk asset rallies, particularly benefiting the cryptocurrency market. Historically, such policy adaptations have translated into positive flows into cryptocurrencies, driven by improved liquidity and sentiment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-collins-rate-cuts-labor-market/