- U.S. jobless claims rise; economic impacts on labor and markets observed.

- Largest increase in initial claims since May, totaling 235,000.

- Stablecoins may see increased use if trends persist.

For the week ending August 16, U.S. jobless claims rose by 11,000 to 235,000, suggesting increased layoff activity and highlighting labor market weaknesses.

This rise in jobless claims could influence financial markets, impacting macro assets like BTC and ETH, though no immediate major on-chain reactions are recorded.

Surge in Jobless Claims and Its Economic Implications

The U.S. Department of Labor announced a marked increase in jobless claims, highlighting growing economic challenges. Initial claims rose to 235,000, the largest leap observed since late May, emphasizing a substantial shift in labor market conditions. Ongoing protectionist trade policies have contributed to these dynamics, impacting business operations.

Immediate market implications include a rise in continuing jobless claims, which reached 1.972 million—the highest since November 2021. Traders are watching for possible impacts on crypto assets like BTC and ETH, as macro-economic stress could drive risk sentiment changes. Investors are cautious of such economic indicators, considering how they historically align with increased stablecoin dominance during risk-off periods.

“In the week ending August 16, the advance figure for seasonally adjusted initial claims was 235,000, an increase of 11,000 from the previous week’s unrevised level of 224,000. … The advance number for seasonally adjusted insured unemployment during the week ending August 9 was 1,972,000, an increase of 30,000 from the previous week’s revised level. This is the highest level for insured unemployment since November 6, 2021.” — U.S. Department of Labor

Crypto Markets Respond to Economic Uncertainty

Did you know? Historical periods with increased jobless claims have often led to heightened volatility in the cryptocurrency market, with stablecoins gaining dominance as investors seek stability in uncertain economic times.

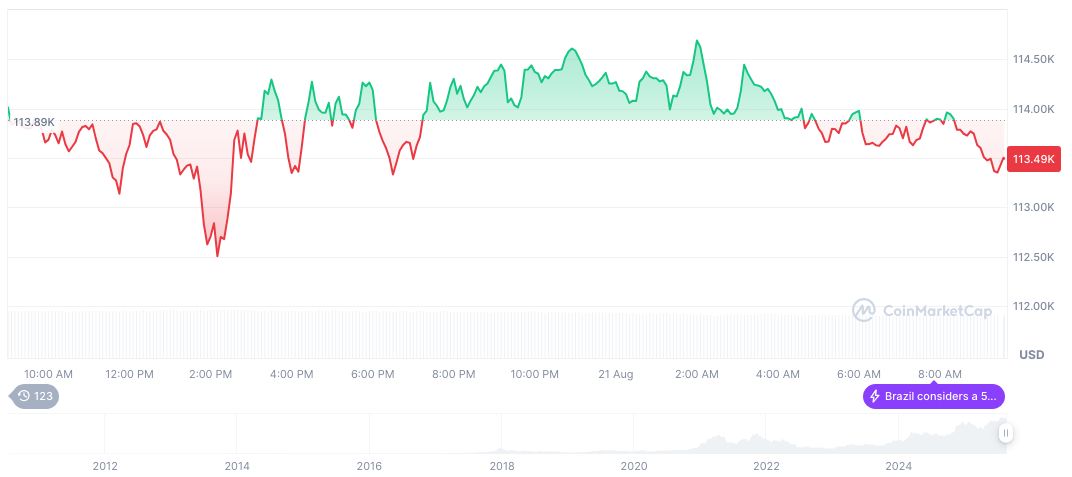

As of 13:05 UTC on August 21, 2025, Bitcoin (BTC) is priced at $113,184.29 with a market cap of $2.25 trillion and dominance at 58.79%, according to CoinMarketCap. Recent data shows a 7-day decline of 4.47% and a 30-day decrease of 5.15%, reflecting underlying market volatility.

Coincu research team indicates that prolonged labor market instability can lead to macroeconomic shifts impacting both crypto and traditional markets. Financial outcomes may include a possible rise in stablecoin adoption if economic uncertainty persists. Technological outcomes remain speculative, often tied to regulatory responses and fiscal policies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-jobless-claims-impact-crypto/