MetaMask, a self-custodial crypto wallet platform, has launched a native stablecoin, namely MetaMask USD (mUSD). The firm is now the first self-custodial wallet provider to create its stablecoin, a milestone that highlights growing competition for dollar-pegged assets.

MetaMask Announces New Stablecoin mUSD

As shared in an announcement, blockchain wallet platform MetaMask is set to launch its own stablecoin, which will be issued by Bridge, a Stripe company, and powered by M0’s decentralized stablecoin infrastructure. The mUSD stablecoin will debut on Ethereum and Linea (AN EVM-equivalent L2 by Consensys).

This move follows the passage of the GENIUS Act last month, which regulates the stablecoin industry. MetaMask said the stablecoin will be deeply integrated into its wallet, enabling seamless onramps, swaps, transfers, and bridging across multiple blockchains. Borrowing from the likes of USDT and USDC, mUSD will serve as a neutral, highly liquid asset backed by highly liquid dollar-equivalent assets on a 1:1 basis.

By year’s end, MetaMask aims to ensure that mUSD holders will be able to spend their tokens via the MetaMask Card at millions of Mastercard merchants worldwide. This will help unlock a range of upcoming product integrations and user benefits.

Furthermore, Gal Eldar – the Product Lead at MetaMask – framed the launch as a breakthrough for self-custody adoption, as noted in the official announcement. Eldar said,

“MetaMask USD is a critical step in bringing the world onchain. By integrating natively into MetaMask’s product offering, it will allow us to cut through some of the most stubborn barriers in web3 and reduce both friction and costs for people onboarding directly into a self-custodial wallet.”

Stablecoin Adoption Continues to Rise

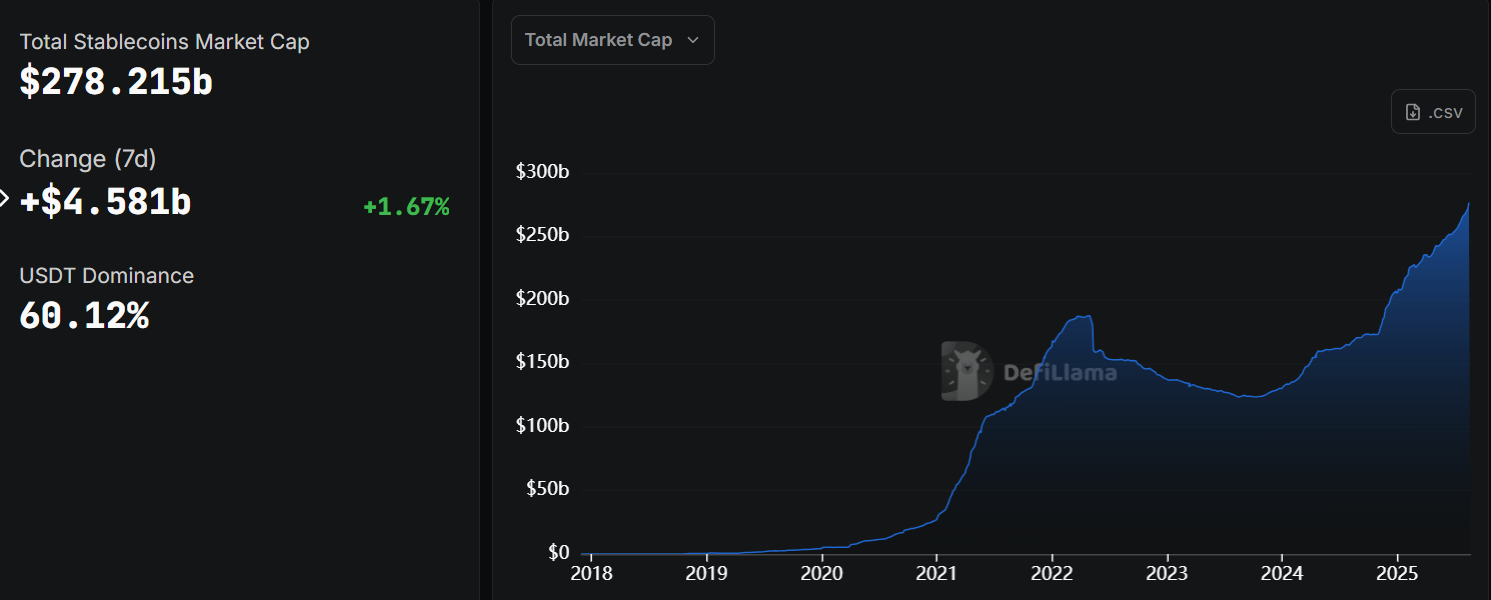

MetaMask’s mUSD launch comes as the stablecoin market continues to expand, with total capitalization surpassing $278.21 billion, according to DefiLlama. With this launch, the crypto wallet platform aims to compete with well-established stablecoins like the USDT, with 60% market share, as well as Circle’s USDC, which comes in second in market share.

Regulators are also taking a greater interest in the stablecoin sector. The passage of the GENIUS Act in the U.S. created the first federal framework for payment stablecoins, giving issuers clearer rules. The Federal Reserve also recently noted that stablecoins could enhance payment system efficiency by reducing settlement risks and costs, as reported by CoinGape.

Outside the U.S., governments are exploring their initiatives. China is reportedly weighing a yuan-backed stablecoin, as reported earlier. This highlights the broader race among nations and platforms to capture a share of the market.

MetaMask’s entry into the stablecoin sector shows that the market is now not a sole domain of exchanges and fintech firms. Wallet-native stablecoins like the mUSD could also shift how people hold and spend in Web3 and beyond.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/joseph-lubins-metamask-unveils-musd-as-stablecoin-market-heats-up/