- Asian families increase cryptocurrency exposure driven by regulatory changes.

- High-net-worth individuals target 5% portfolio allocation.

- Demand for crypto funds surges amid institutional participation.

Wealthy Asian families are significantly boosting cryptocurrency investments, driven by optimistic digital asset forecasts and favorable regulatory conditions in regions like Singapore, Hong Kong, and South Korea as of August 21, 2025.

This shift in investment strategies highlights growing acceptance of digital assets among institutions and potential impacts on market dynamics, evident from increased trading volumes and investor interest.

Asian Wealthy Families Increase Cryptocurrency Investments

Wealthy Asian families and family offices are boosting their cryptocurrency exposure, signaling a notable shift in regional sentiment. NextGen Digital Venture’s Jason Huang announced raising over $100 million, showing strong demand from investors comprising mainly of family offices and fintech entrepreneurs. This increased interest highlights a growing acceptance of digital assets in diverse portfolios.

Changes include heightened investments and intentions to allocate up to 5% in digital assets. UBS reports that Chinese family offices plan to increase their crypto exposure. Positive regulatory frameworks in locations like Hong Kong strengthen investor confidence, boosting cryptocurrency’s asset class standing.

*”We raised over $100 million in just a few months, and the response from LPs has been encouraging. Our investors—mainly family offices and internet/fintech entrepreneurs—recognise the growing role of digital assets in diversified portfolios.”* — Jason Huang, Founder, NextGen Digital Venture source

Market reactions have been notably positive. HashKey Exchange in Hong Kong has seen an 85% annual rise in registered users, while South Korean exchanges reported a 17% increase in trading volumes. Key industry figures, including UBS’s Lu Zijie, emphasize the readiness of younger family office generations to adopt virtual currencies.

Bitcoin’s Price and Market Trends Amid Rising Demand

Did you know? In past bull runs like 2017 and 2021, increased crypto exposure among Asian family offices led to short-term trading volume spikes.

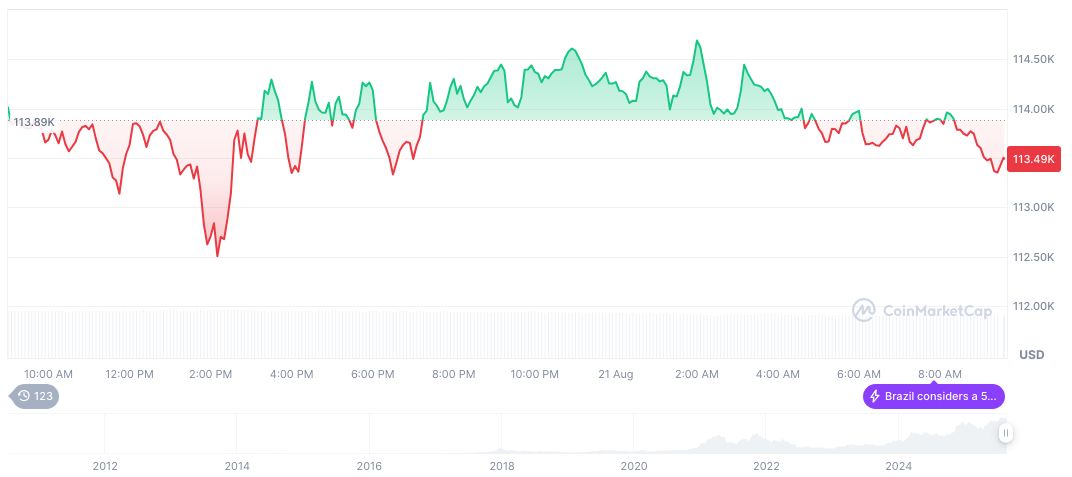

Bitcoin (BTC), priced at $113,398.15, commands a market cap of approximately $2.26 trillion and holds a 58.69% market dominance, according to CoinMarketCap. Trading volume stands at $64.85 billion, declining by 10.1% in the last 24 hours. Despite a 0.36% price drop in the past day, Bitcoin maintains steady growth over recent months with rises of 10.59% over 60 days and 2.14% over 90 days.

Coincu’s research team highlights potential long-term outcomes stemming from ongoing cryptocurrency integration into mainstream institutional portfolios. Stronger regulatory frameworks in Asia could amplify digital asset legitimacy. In historical movements, acceptable volatility and structured allocations in diversified portfolios may establish crypto as an enduring financial component among investors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/asian-families-crypto-investment/