- Bitcoin inflow drops; Ethereum gains dominance with 67% perpetual trading.

- Increased altcoin speculation amid weakening Bitcoin demand.

- Market reflects late-stage cycle characteristics with profit-taking trends.

Glassnode reports Bitcoin’s capital inflows are weakening despite reaching $124,400, as speculative positions in altcoins surge, with Ethereum becoming a key market volatility barometer.

The trend reflects late-cycle market dynamics, including increased altcoin speculation and Ethereum’s dominance in derivative trading, raising questions about continued momentum and market stability.

Bitcoin Inflows Dip Amid Record $60 Billion in Altcoin Futures

Bitcoin showed signs of capital inflow exhaustion, even as its price hit an all-time high of $124,400. This led to a restructuring in market behavior, with Ethereum escalated as a significant trading asset. Analysts from Glassnode noted that Ethereum’s perpetual contract trading surged to 67%, reflecting a structural shift in the market.

Weakening demand for Bitcoin was offset by speculative activities, notably in altcoins. Open interest in altcoin futures contracts topped $60 billion but retracted by $2.5 billion as traders recalibrated their positions in the face of slackening foundational demand.

Community reactions indicate skepticism about the longevity of such trends. Although official comments from key figures were scarce, market sentiment relayed through institutional actions demonstrate a pivot toward speculative altcoin leverage. Glassnode, an on-chain analytics firm, mentioned, “Capital inflows into Bitcoin are showing signs of fatigue, with demand softening even as price set a new ATH at $124.4k. This slowing appetite is further illustrated by weaker realized cap growth and a higher proportion of profit-taking among long-term holders. Open interest and speculative activity has reached record highs in altcoins, while Ethereum perpetual dominance has surged, highlighting a shift in market structure toward leveraged trading.” The broader sentiment reflects intensified speculative behavior linked to historical market ends.

Market Experts Predict Complexities in Crypto’s Late-Stage Cycle

Did you know? Ethereum’s trading dominance reached a soaring 67%, a structural adjustment unmatched even in prior Ethereum highs, highlighting its rising role in crypto’s speculation landscape.

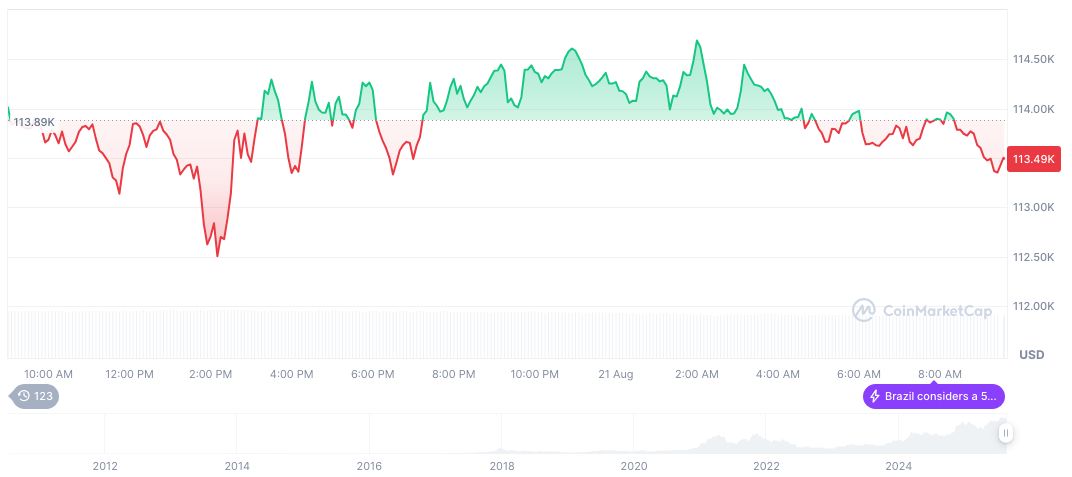

As of August 21, 2025, CoinMarketCap data shows Bitcoin’s price at formatNumber(“113267.43”, 2), with a market cap of formatNumber(“2255083829336”, 2), dominating 58.61% of the crypto market. With a fully diluted market cap at formatNumber(“2378616125120”, 2) and a 24-hour trading volume hitting formatNumber(“65043510980”, 2), Bitcoin experienced a slight price downturn of 0.45% within 24 hours. Over seven days, it plunged by 6.84%. Its circulating supply stands at 19,909,375, aiming for a maximum supply of 21,000,000.

Experts project increasing financial and regulatory complexities as profit-taking by long-term holders parallels trends observed in prior cycles, according to the Coincu research team. Potential outcomes could be guided by evolving regulatory landscapes and market structures underpinning current speculative dynamics. These dynamics warrant careful monitoring to discern future cryptocurrency trajectory.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/bitcoin-inflow-weakens-ethereum-speculation/