- Fed focuses on inflation risks and maintains interest rates, affecting markets.

- The dollar strengthens, impacting cryptocurrency valuations.

- Markets await Fed Chair Powell’s Jackson Hole speech.

The Federal Reserve’s July meeting minutes reveal policymakers prioritizing inflation risks over a slow labor market, impacting the dollar’s value before key speeches at the Jackson Hole Symposium.

Market attention shifts to Fed Chair Powell’s Jackson Hole speech, potentially influencing cryptocurrency volatility amid Dollar strength and labor market data.

Fed’s Inflation Focus Strengthens US Dollar

The minutes reveal that the Federal Reserve prioritized managing inflation risks over addressing potential weaknesses in the labor market during its July meeting. Fed Chair Jerome Powell guided the discussions, and the decision was made to maintain the current interest rates, highlighting inflation as a greater threat.

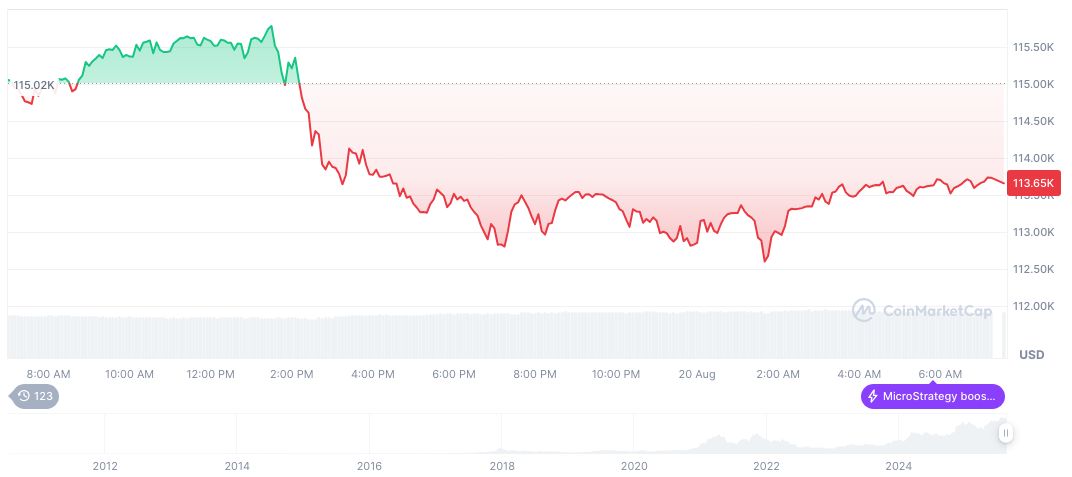

The immediate effect of the minutes was an observed increase in the strength of the US dollar, influencing commodity and cryptocurrency markets. As a consequence, Bitcoin and Ethereum experienced a slight decline as a result of the strengthened dollar.

Participants generally pointed to risks to both sides of the Committee’s dual mandate, emphasizing upside risk to inflation and downside risk to employment. — FOMC Minutes, July 2025 Federal Reserve FOMC Minutes

Market analysts have shown varied responses. A report from Danske Bank described the minutes as somewhat stale, given their timing before recent jobs data. Focused anticipation surrounds Fed Chair Powell’s upcoming remarks at the Jackson Hole Symposium, where any guidance may bear significant market influence.

Historical Patterns Suggest Inflation Priority Continues

Did you know? Historically, the Federal Reserve often leans towards prioritizing inflation control over labor market concerns, as seen during the 2022-23 rate hike cycles. This suggests a prolonged emphasis on monetary stability in present deliberations.

Bitcoin’s current valuation is $113,673.64, supported by a substantial market cap of formatNumber(2263165064401, 2). Despite a recent price drop of -2.36% over the past 24 hours, Bitcoin remains a dominant force, holding a market sector command of 58.53%, per CoinMarketCap data.

Analysts from CoinCu suggest that the Federal Reserve’s rigid focus on inflation could provoke intensified market reactions, especially if Powell’s speech signals shifts in policy directions. This observation points to longer-term implications for cryptocurrency markets as they adjust to monetary trends.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-minutes-inflation-labor-concerns/