- Federal Reserve keeps interest rates steady at 4.25%-4.5% due to inflation concerns.

- Community reactions to Fed’s decision are mixed, highlighting tariff-induced inflation impacts.

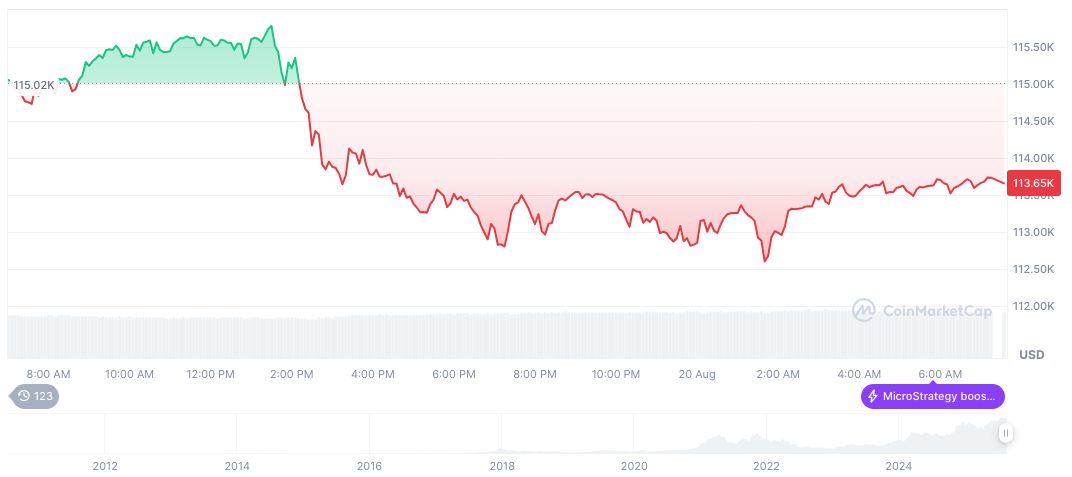

- Bitcoin trades steadily at over $113,000, with minor market movement observed post announcement.

The Federal Reserve held the federal funds rate steady at 4.25%-4.5% during its July meeting, citing moderate GDP growth and persistent high inflation pressures.

The decision impacts financial markets, as elevated inflation and interest remain challenges for crypto valuations, highlighting the Fed’s caution despite internal dissent for a rate cut.

Fed Rate Decision Highlights Inflation Concerns and Reactions

The Federal Reserve decided to maintain the federal funds rate at its existing level during the recent July 2025 meeting. Chair Jerome Powell highlighted ongoing inflation concerns and moderate GDP growth as key factors.

Several significant implications emanate from this decision. Persisting tariff-induced inflation pressures might deter the Fed from future rate reductions, affecting market liquidity.

“The unemployment rate remains low, and labor market is at or near maximum employment. Inflation has come down a great deal but has been running somewhat above our 2 percent longer-run objective.” — Jerome Powell, Chair, Federal Reserve

Community reactions have been varied, with notable mention from 21Shares’ Matt Mena, who emphasized that tariff-induced inflation could influence Fed actions. The crypto community expressed caution while awaiting clarity on subsequent economic indicators.

Bitcoin Trades at $113,341 as Market Awaits Clarity

Did you know? The Federal Reserve’s decisions can significantly impact cryptocurrency markets, as seen in past rate changes.

The current Bitcoin metrics include a trading price of $113,341.72, with a market cap of $2.26 trillion and dominance of 58.69%. Its 24-hour trading volume reached $72.15 billion, reflecting a recent price uptick of 0.10% as per CoinMarketCap data.

Insights from Coincu suggest potential regulatory outcomes as the Fed maintains a cautious approach. Looking ahead, inflation trends and monetary policy could shape liquidity access, impacting cryptocurrency investment flows.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-decision-market-impact/