- Main event: Powell’s planned Jackson Hole speech on labor market’s centrality to monetary policy.

- Labor focus signals potential shift in policy approach.

- Cryptocurrencies may respond to economic policy direction.

Federal Reserve Chairman Jerome Powell is anticipated to address the shifting focus towards employment over inflation at the Jackson Hole Symposium on August 20, 2025.

Powell’s remarks may influence monetary policy directions, impacting global markets, and could lead to fluctuations in cryptocurrency valuations, notably affecting major assets like BTC and ETH.

Powell’s Jackson Hole Speech to Focus on Employment

Federal Reserve Chairman Jerome Powell is expected to highlight the transition of labor dynamics in monetary policy during the forthcoming Jackson Hole symposium. Key players like Mabrouk Chetouane have pointed out Powell’s shift in focus from inflation to employment targets, signaling significant policy implications. Mabrouk, a prominent market strategist, has stressed that inflation concerns persist, necessitating clarity on policy directions.

Financial markets might react to Powell’s emphasis, with major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) susceptible to shifts in macroeconomic signals. Adaptations in the Fed’s policy approach could influence capital flows into digital assets, affecting their liquidity and market dynamics.

Mabrouk Chetouane, Global Market Strategist, La Française Investment Solutions, “We are preparing for volatility and uncertainty in the Federal Reserve’s leadership as persistent US inflation remains a risk, especially with dovish expectations ahead of major policy events.”

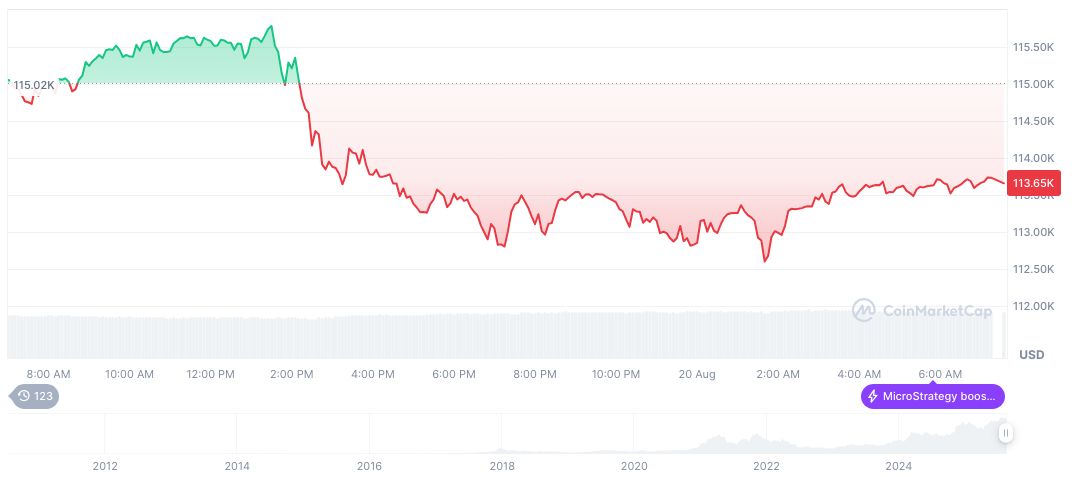

Bitcoin Price Data and Potential Market Reactions

Did you know? Past symposium themes heavily influenced DeFi token dynamics, especially with priority shifts between inflation and employment goals, impacting decentralized financial flows.

Bitcoin (BTC) is currently priced at $114,028.58 with a market cap of $2.27 trillion and dominance of 58.56%, as per CoinMarketCap. Its trading volume reached $72.07 billion over the last 24 hours, showing a 0.49% price spike. The currency has experienced variances, dipping 6.45% over the past week but growing 10.33% over the past two months. The max supply stands at 21 million, with 19,909,075 circulating. Updated as of 18:03 UTC, August 20, 2025.

Insights from Coincu’s team suggest potential regulatory recalibrations linked to Fed decisions could lead to adaptive crypto market movements. Market structure changes may involve policies affecting funding, liquidity, and trading dynamics, which could significantly alter asset volatility and sector growth trajectories.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/powell-labor-role-fed-policy/