The FOMC minutes have highlighted how the Federal Reserve currently considers the inflation risk as being greater than the risk of a weakening labor market. This has led to a drop in the odds of a September Fed rate cut even as Jerome Powell prepares to speak at the Jackson Hole conference on August 22.

FOMC Minutes Show Fed Is More Worried About Inflation

According to the Federal Reserve minutes for the July FOMC meeting, a majority of participants judged the upside risk to inflation as being greater than the downside risk to employment. Meanwhile, several others viewed the two risks as being balanced, while a couple of participants considered the downside risk to employment as being greater.

As CoinGape earlier reported, crypto market participants were looking forward to the FOMC minutes to gain insights into the Fed’s next move and whether they would make a September Fed rate cut. However, based on the minutes, a rate cut is still up in the air, given that the Committee’s greater concern is inflation rather than a weakening labor market.

Notably, inflation looks to be on the rise as the U.S. PPI rose to 3.3%, year-over-year (YoY) in July. On the other hand, the labor market also looks to be weakening as the July nonfarm payrolls rose to 73,000, way below expectations of 147,000.

Therefore, the Fed is currently at a crossroads as to whether to hold rates steady due to inflation concerns or lower rates because of the weakening labor market. The FOMC minutes suggest that the Committee is likely to pick the former.

It is worth noting that the many participants noted that full effect of the Trump tariffs could take some time. They remarked that tariff-related factors could lead “to stubbornly elevated inflation,” possibly making it difficult to disentangle tariff-related price increases from changes in underlying trend inflation

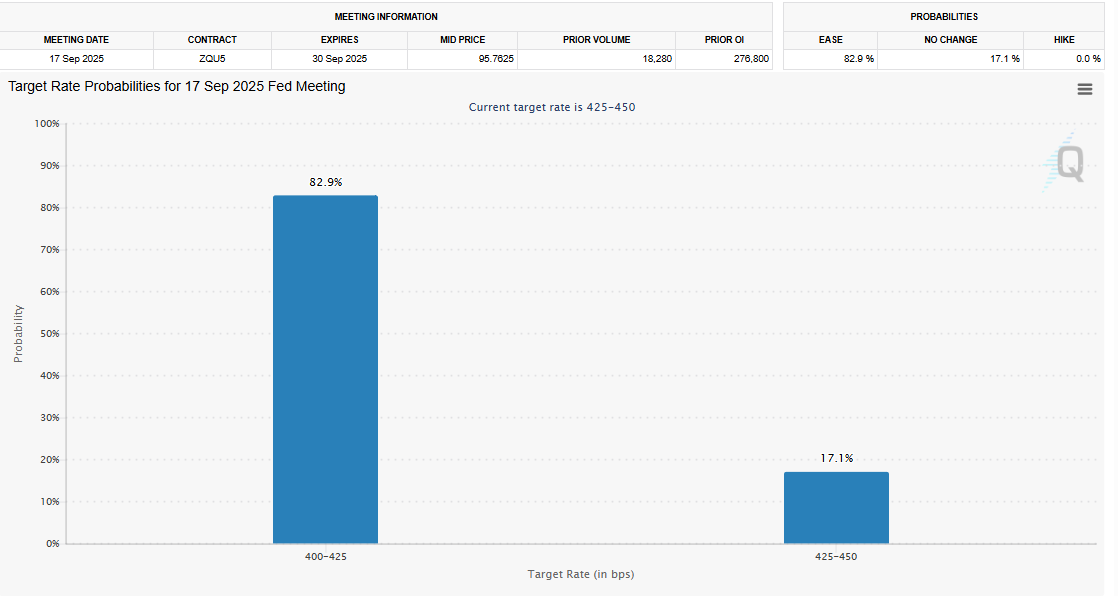

September Rate Cut Odds Drop

CME FedWatch data showed that the odds of a 25 basis point (bps) September rate cut slight dropped to 82.9% from around 85%, following the release of the FOMC minutes.

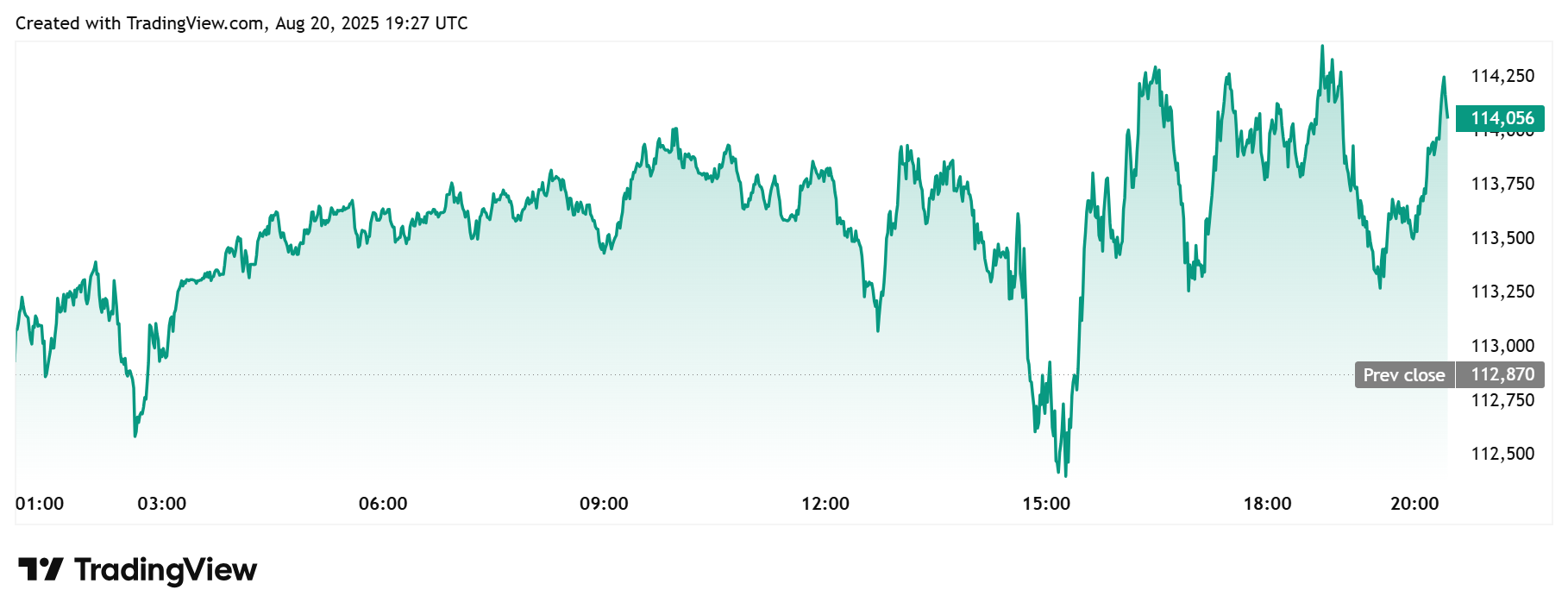

Meanwhile, the Bitcoin price sharply dropped to around $113,300 on the back of the minutes release. However, the flagship crypto alongside the broader crypto market quickly recovered, with BTC breaking above $114,000 again.

Now, crypto market participants will turn their attention to Jerome Powell’s speech at the Jackson Hole conference on August 22 to see if the Fed Chair is currently hawkish or dovish.

His speech could also provide insights into whether the Fed’s priority is still inflation following the release of both the PPI data and jobs data. Notably, both data dropped after the Fed decided to keep rates unchanged at the July 30 meeting.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/fomc-minutes-show-inflation-priority-over-jobs-september-rate-cuts-in-doubt/