- US short-term interest rates face upward risks, impacting crypto markets.

- Market expectations of Fed rate cuts are overly optimistic.

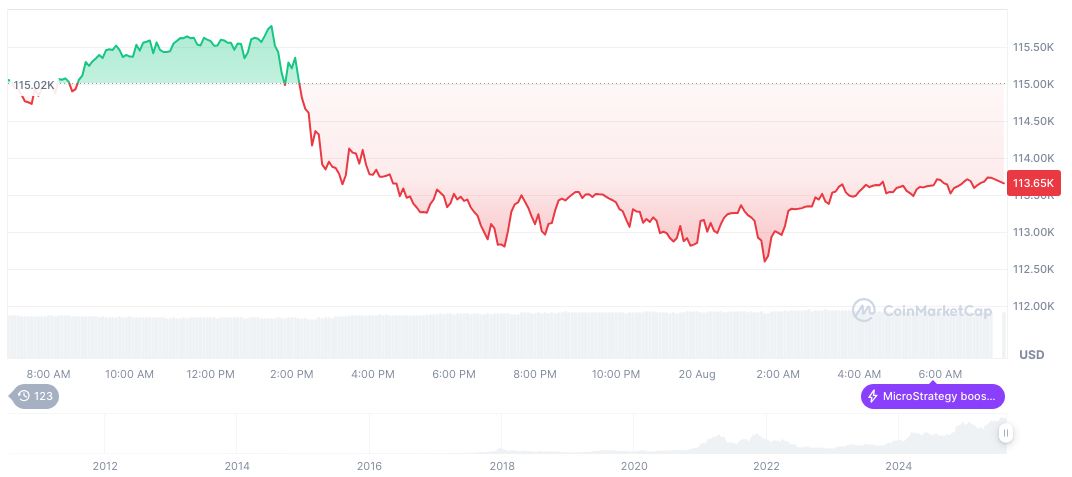

- Crypto asset prices, notably BTC and ETH, show declines.

On August 20, 2025, Kevin Thozet of TCW Group highlighted upward risks to US short-term interest rates, cautioning against overconfidence in imminent Federal Reserve rate cuts.

His statement impacts market sentiment, leading to declines in cryptocurrency prices, particularly Bitcoin and Ethereum, amid increased macroeconomic uncertainty and inflationary pressures.

Fed Rate Expectations Overestimated, Warns Expert

Kevin Thozet of TCW Group highlighted US short-term interest rate risks, suggesting market complacency. Thozet, a known expert in macro strategy, pointed out overconfidence regarding the Fed’s anticipated rate cuts. In response, market participants remain wary amid multiple global uncertainties. Immediate implications suggest potential dampening of growth perspectives and an adjustment in financial forecasts. Market expectations appear misaligned with economic realities, possibly affecting liquidity strategies. The crypto market responded with noted declines in major assets like Bitcoin and Ethereum, reflecting investor caution. “Institutional capital is flowing into the spot ETF at a record pace. Publicly traded companies are viewing Bitcoin as a strategic reserve asset. The White House is actively supporting this asset class. Sovereign nations’ Bitcoin investments have been profitable,” said Nigel Green, CEO of deVere Group. Thozet’s comments underscore a cautious approach to expectations, influencing broader market sentiment and price movements.

Historical Context, Price Data, and Expert Analysis

Coincu’s research notes that ongoing rate hikes may suppress liquidity, affecting market dynamics. Such policy shifts could lead to strategic adjustments across financial sectors.

Historical Crypto Response to Fed Movement Analyzed

Did you know? The anticipated Federal Reserve rate adjustments have historically influenced crypto volatility. In early 2025, similar uncertainties resulted in notable market corrections, illustrating the significant correlation between macroeconomic policies and digital asset performance.

Bitcoin stands at $113,935.71, with a market cap of $2.27 trillion, showing a 0.32% gain over 24 hours. Recently, it has experienced a 6.46% fall over the past seven days. Data via CoinMarketCap.

Coincu’s research notes that ongoing rate hikes may suppress liquidity, affecting market dynamics. Such policy shifts could lead to strategic adjustments across financial sectors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-rate-risks-crypto-impact/