Bitcoin, developed in 2008-2009, has gone through a lot of challenges, including the popular doomsday prediction by a Harvard economist. Similar to any asset, its trajectory has been filled with many ups and downs, breaking people’s belief in the investment occasionally. However, BTC rose above all, hitting $124.4k earlier this month, with experts predicting a $200k milestone by 2025 end.

What Was Harvard Economist Kenneth Bitcoin Prediction

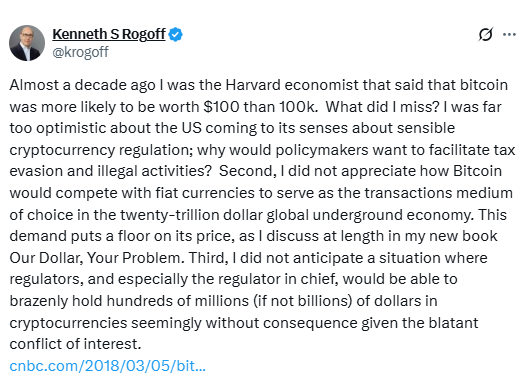

Back in 2018, Harvard economist Kenneth S Rogoff made a bold prediction, saying it is “far more likely to hit $100 than $100k” in the next ten years. Notably, this prediction was made at the time when BTC price declined to $11k from its 2017 ATH of $20k. Soon after the prediction, the token did collapse to $3k. However, it rebounded, hitting $124.4k in August 2025.

- Source: CNBC, Harvard Economist’s 10 Year Prediction

Rogoff also added that this digital asset has no value other than being used in money laundering and tax evasion. He anticipated that the government regulation would wipe out its demand, causing it to crash by around $100.

Bitcoin Disproves Doomsday Prediction- Harvard Economist Accepts

As Bitcoin shines bright as the seventh biggest asset in the world with $1.23T market cap, Rogoff has come forward accepting his defeat. Not only has it surpassed the $100k mark in December 2024, but it has even crossed the $124k milestone, gaining 1,000% above its doomsday prediction.

- Source: CoinMarketCap, BTC Price Chart

This happened as BTC gained global adoption, with retail and institutional investors going big on BTC investment. Starting with MicroStrategy’s BTC buying strategy to even Harvard University owning an endowment fund ($116M investment in BlackRock’s spot Bitcoin ETF), this digital asset went hard against the economist’s prediction.

Why Was Kenneth Rogoff Wrong About Bitcoin?

In an X post, citing his new book ‘Our Dollar, Your Problem,’ Rogers acknowledged that he miscalculated three factors, resulting in prediction failure. Starting with the regulatory miscalculation, he revealed that he had anticipated a harsher U.S. regulatory approach, which could kill BTC’s growth.

- Source: X, Kenneth Rogoff

Trump’s crypto approach, including the passing of GENIUS ACT into law and other favorable regulatory developments, has supported BTC’s growth. Even the SEC turned favorable for the crypto industry. Recently, Paul Atkin suggested the building of a future-proof regulatory framework for the crypto market, helping with the adoption.

We must craft a framework that future proofs the crypto markets against regulatory mischief. I look forward to working with my counterparts across the Administration and Congress to get the job done.

— Paul Atkins (@SECPaulSAtkins) August 19, 2025

Rogoff also added that he miscalculated the role this digital asset would play in the $20T underground economy, competing with the U.S. dollar. Notably, Bitcoin became the medium of transaction, and even its role in illicit activity remained at $50B, a fraction of global cash laundering.

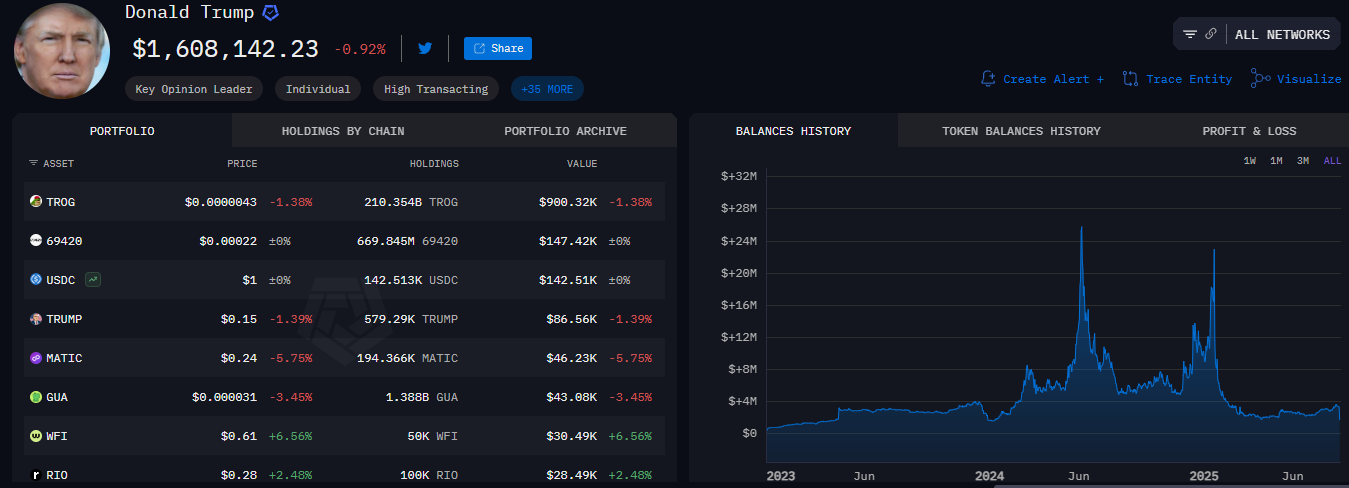

Lastly, he did not foresee the regulators or even the leaders accumulating these digital assets. A prime example of this is Donald Trump’s crypto portfolio of $1.6 billion, along with $2.1B in his Trump Media company.

- Source: Arkham, Donald Trump Crypto Portfolio

Overall, he claimed that the rising conflict of interest and the reshaped crypto policy have fueled BTC growth, making his prediction go wrong. With this, Rogoff has joined the long list of crypto skeptics like Warren Buffett who once doubted BTC’s value, but have now changed their stances.

On the other side, Bitcoin has surged way past the $100k milestone, establishing a place in the financial ecosystem.

Frequently Asked Questions (FAQs)

In 2018, Rogoff predicted that Bitcoin would more likely hit $100 rather than $100k.

Rogoff acknowledged that his prediction failed, citing his miscalculation of regulatory development and conflict of interest.

Bitcoin has had tremendous growth over the last 7 years, hitting an ATH of $124.4k under the catalysts of retail and institutional demand, spot ETF launch, and more.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/trending/btc-more-likely-to-hit-100-than-100000-harvard-economist-proven-wrong-as-bitcoin-breaks-120k/