- China potentially allowing yuan-backed stablecoin for global expansion.

- Tech firms propose stablecoin in Hong Kong for currency reach.

- Regulations and cautious optimism from industry and government leaders.

China considers introducing a yuan-backed stablecoin in Hong Kong, as tech giants propose new developments amid regulatory shifts.

This could transform international currency dynamics, integrated with Hong Kong’s forthcoming Stablecoin Ordinance, impacting cross-border payments and currency flows.

China’s Stablecoin Strategy Targets Global Financial Integration

China considers a yuan-backed stablecoin proposal. Tech companies like JD.com have actively approached the People’s Bank of China (PBOC) with suggestions for a stablecoin linked to the offshore yuan, indicating significant corporate interest in understanding stablecoins and their regulatory framework.

Such a stablecoin proposition marks a potential shift in China’s currency policy. Hong Kong emerges as a pivotal hub for testing and regulation under the planned Stablecoin Ordinance set to take hold by August 1, 2025. This regulatory framework could influence the broader financial ecosystem by setting new operational standards.

Eddie Yue, Chief Executive, Hong Kong Monetary Authority (HKMA), cautioned in a recent press conference: “Rein in the euphoria” over stablecoins, calling some discussions “overly idealistic” concerning their ability to “disrupt the mainstream financial system.”

Hong Kong’s Regulatory Role and Market Dynamics

Did you know? Hong Kong’s role as a regulatory sandbox has historically enabled the testing of numerous financial products, aligning with 2025’s rigorous framework for stablecoins.

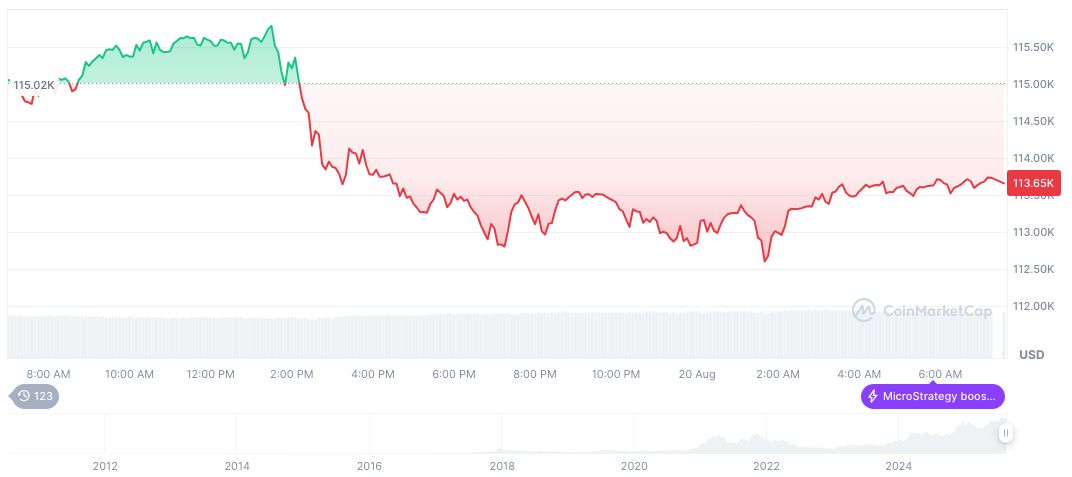

Bitcoin (BTC) currently trades at $113,774.44, with a market cap of $2.27 trillion and a dominance of 59.10%. Recent performance shows a 1.46% decline over 24 hours and a 5.56% drop over the week. Trading volume reached $72.28 billion, per CoinMarketCap as of August 20, 2025.

The Coincu research team emphasizes the potential economic ramifications of a yuan-backed stablecoin, noting the dynamics it introduces to cross-border financial interactions. Regulatory adjustments and a robust technological architecture could further facilitate this integration into global trade systems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/china-yuan-stablecoin-global-power/