- Bitcoin’s price fell below $113,000, affecting market sentiment and dynamics.

- Retail sentiment hits record pessimism since the June 22 market scare.

- Analysts suggest potential buying opportunity amid negative sentiment.

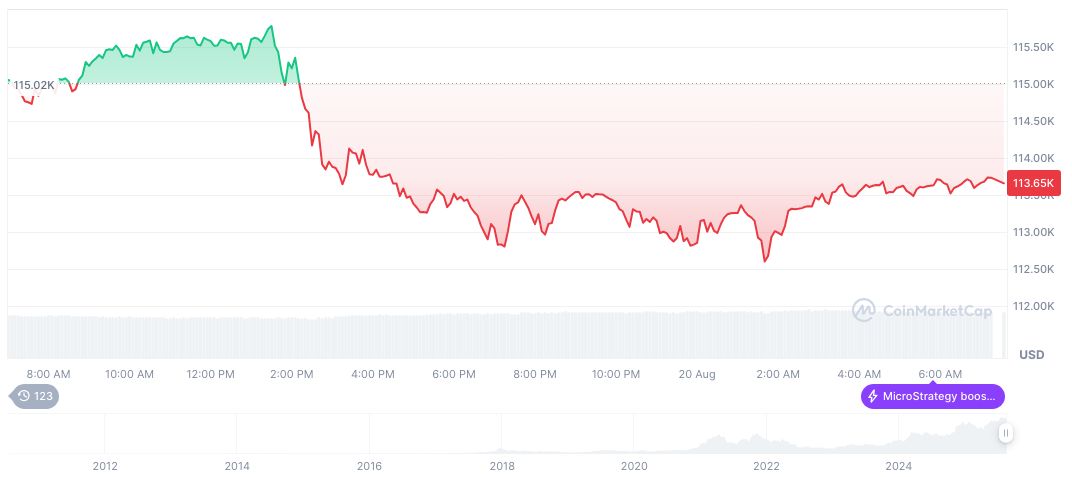

Bitcoin’s value plummeted below $113,000 on August 20, prompting Santiment to report the most negative retail sentiment since June 22, reflecting widespread pessimism across social media.

Such negative sentiment historically signals potential market reversals, with patterns indicating a buying opportunity for patient investors amid a continued bearish outlook.

Retail Sentiment Hits New Low as Bitcoin Falls

Bitcoin’s value declined sharply, dropping below $113,000, influencing retail investor sentiment negatively. Santiment noted that retail traders shifted to a highly pessimistic outlook following this decline. Analysts point out that this is the worst sentiment since a similar event in June. “Retail traders have done a complete 180 after Bitcoin failed to rally and dipped below $113,000. The most bearish sentiment seen on social media since June 22. Markets move in the opposite direction of the crowd’s expectations.” — Maksim Balashevich, Founder, Santiment Source.

The market reaction to Bitcoin’s decline saw a shift towards risk aversion. The Fear & Greed Index dropped sharply, indicating rising fear among investors.

Market observers and analysts have emphasized the divergence between retail sentiment and market actions. Historical patterns highlight that markets tend to move counter to prevailing sentiment, suggesting a potential for recovery.

Historical Trends Suggest Potential Rebound for Bitcoin

Did you know? Extreme retail pessimism has historically led to major rallies, notably seen in 2017 and 2021, when similar sentiment shifts resulted in 36% and 23% positive price reversals, respectively.

Bitcoin (BTC) is currently priced at $113,841.28, with a market cap of $2.27 trillion, garnering a dominant 58.99% market share, as per CoinMarketCap. Its 24-hour trading volume rose by 14.94%, reaching $72.38 billion. Over the past 24 hours, Bitcoin experienced a price decline of 1.48%.

Coincu’s research team anticipates potential financial and technological outcomes as a function of retail sentiment. Negative sentiment, contrasted with historical analysis, suggests a market poised for a bullish reversal once sentiment normalizes, aligning with behavioral finance theories of market psychology.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitcoin-sentiment-record-pessimism/