- Michelle Bowman’s proposal to allow Fed staff minimal crypto holdings aims to boost regulatory understanding.

- Suggestion reflects possible long-term changes in crypto oversight from the Federal Reserve.

- Immediate market impacts are minimal; no direct market interventions announced.

Federal Reserve Vice Chair for Supervision Michelle Bowman proposed allowing staff to hold small amounts of cryptocurrencies to enhance regulatory insights during a speech in Wyoming on August 19, 2025.

This proposal aims to improve Federal Reserve staff’s understanding of crypto markets through direct exposure, marking a shift toward a more open regulatory perspective.

Bowman Advocates for Regulatory Insight Through Crypto Holdings

“Our approach should consider allowing Federal Reserve staff to hold de minimis amounts of crypto or other types of digital assets so they can better understand these markets through firsthand experience.” — Michelle Bowman, Vice Chair for Supervision, Federal Reserve

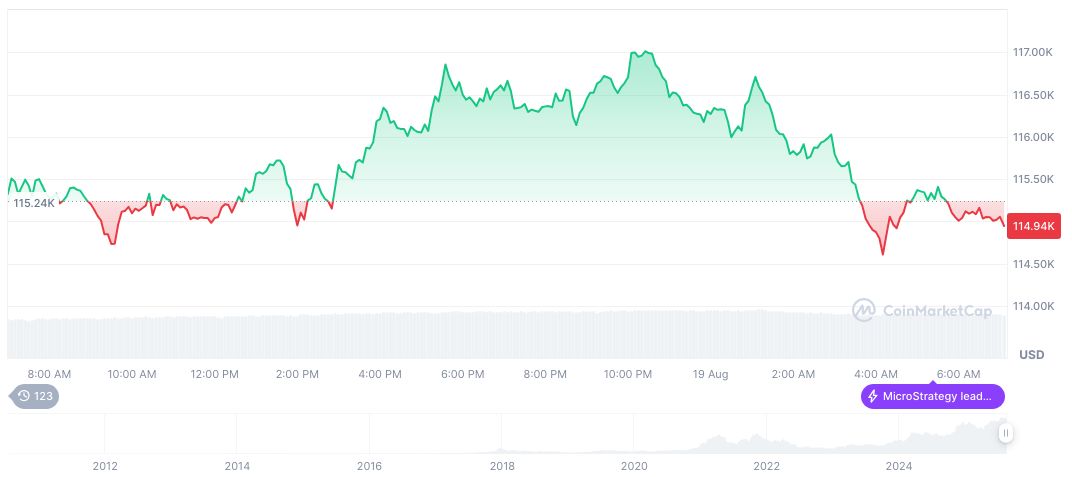

Market reactions remain muted, with no significant change in crypto prices or trading volumes reported. Industry leaders have yet to formally respond to Bowman’s comments.

Market reactions remain muted, with no significant change in crypto prices or trading volumes reported. Industry leaders have yet to formally respond to Bowman’s comments.

Historical Perspective and Financial Metrics Analysis

Did you know? Historically, allowing regulatory staff direct asset holdings is uncommon among global financial bodies, with most enforcing strict ownership rules to prevent conflicts of interest.

According to CoinMarketCap data, Bitcoin’s current price stands at $113,109.35 with a market cap of $2.25 trillion. Trading volumes have declined by 2.43% in the past 24 hours, while the price has decreased 2.78% over the same period.

Coincu’s research team notes that understanding crypto mechanics may result in more informed future policies. As exposure increases, there may also be potential benefits in recruitment and talent retention, key factors in regulatory efficacy. As exposure increases, there may also be potential benefits in recruitment and talent retention, key factors in regulatory efficacy.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/fed-bowman-crypto-holdings-proposal/