- Federal Reserve’s Michelle Bowman suggests staff could hold small crypto amounts.

- Proposal aims to enhance understanding and attract skilled talent.

- Potential regulatory shift could influence market sentiment towards large-cap assets.

Federal Reserve Vice Chair for Supervision, Michelle Bowman, suggested allowing staff to own minimal cryptocurrency amounts to enhance understanding during the Wyoming Blockchain Symposium on August 20, 2025.

Bowman’s proposal indicates a potential regulatory shift, possibly affecting market sentiment toward major cryptocurrencies like BTC and ETH, aiming to attract specialized talent at the Federal Reserve.

Federal Reserve’s Proposal Promises Crypto Regulatory Shift

Michelle Bowman justified the proposal by highlighting the challenges of recruiting skilled examiners if staff cannot personally own cryptocurrencies. She suggested allowing Federal Reserve staff to hold small crypto amounts to foster better familiarity with digital assets. “Our approach should consider allowing Federal Reserve staff to hold de minimus amounts of crypto or other types of digital assets so they can better understand the risks and opportunities associated with these assets, and so we can attract and retain the talent necessary to effectively supervise innovative activities,” stated Bowman. The move is seen as an attempt to create a balanced regulation approach, keeping the Federal Reserve competitive in talent acquisition within the fintech sector.

Immediate implications could include a shift towards a more crypto-friendly regulatory environment at the Federal Reserve. This relaxation could position the organization as more receptive to digital asset engagement, potentially influencing broader regulatory attitudes. No specific details or timelines were disclosed for implementing this policy change, reflecting an early stage in consideration and discussion.

While major crypto figures have yet to publicly respond, sentiment might echo past reactions to regulatory softening. Historically, market participants associate such news with potential bullish sentiment for large-cap cryptocurrencies like Bitcoin and Ethereum, viewing regulatory openness as positive.

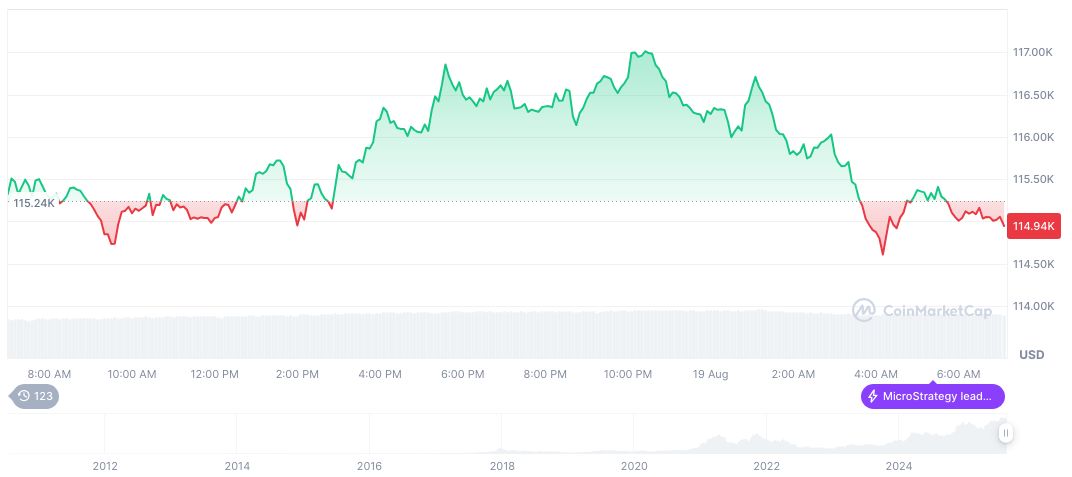

Bitcoin’s Market Performance Amid Regulatory Discussions

Did you know? In 2020, U.S. banks received approval to provide cryptocurrency custody services, signaling increased regulatory acceptance of digital assets.

Bitcoin’s price stands at $113,233.35 with a market cap of $2.25 trillion. Recent price movements show a -2.81% decline in 24 hours, though it has gained 9.62% over the last 60 days, per CoinMarketCap data. Bitcoin’s 24-hour trading volume reached $68.38 billion, reflecting a -4.49% change.

The Coincu research team anticipates Bowman’s proposal could lead to broader adoption of crypto-friendly policies in financial regulation. Aligning Federal Reserve practices with emerging digital assets might foster positive market sentiment and enhance the institution’s monitoring capabilities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/federal-reserve-staff-crypto-holdings/