- Scott Bessent leads Federal Reserve Chair interviews with 11 candidates.

- Process includes insights into monetary and regulatory policy.

- No market impact data is available as of now.

Treasury Secretary Scott Bessent has commenced interviews with 11 potential candidates to succeed Jerome Powell as Federal Reserve Chair, aiming for a diverse selection process.

This decision holds significant market interest, as changes in Fed leadership traditionally impact monetary policy and, consequently, influence cryptocurrency price volatility and financial market stability.

Bessent’s Role in Selecting Powell’s Successor

Scott Bessent’s leadership in the Federal Reserve Chair interviews is part of a strategic move by the Trump administration to ensure a fitting successor to Jerome Powell. A diverse pool of candidates from within and outside the Federal Reserve is considered for this crucial role. Bessent, in his official communications, emphasizes looking at monetary policy, regulatory policy, and organizational management during his evaluations. Jerome Powell’s current term ends in May 2026, prompting these proceedings to find a successor who can influence U.S. monetary policy direction significantly.

Changes anticipated due to these interviews include potential adjustments to future interest rate policies that can affect risk assets, including cryptocurrencies. Market stakeholders are keenly observing how these appointments may signal shifts in monetary policy frameworks. Bessent’s methodical approach prioritizes monetary stability and ensuring the independence of the Federal Reserve, indicating significant attention on how these factors shape the next chair’s duties.

“As I talk to the candidates, I’m looking at three things: monetary policy, regulatory policy, and the ability to run and revamp the organization, because it’s really gotten bloated and I think this bloat puts its monetary independence at risk.” — Scott Bessent, Treasury Secretary, U.S. Department of the Treasury

Market Implications of Fed Chair Selection

Did you know? Previous transitions in Federal Reserve leadership, such as the appointment of Yellen in 2013 and Powell in 2018, have historically led to initial volatility in the markets, affecting cryptocurrencies like Bitcoin and Ethereum temporarily due to new monetary policy directions.

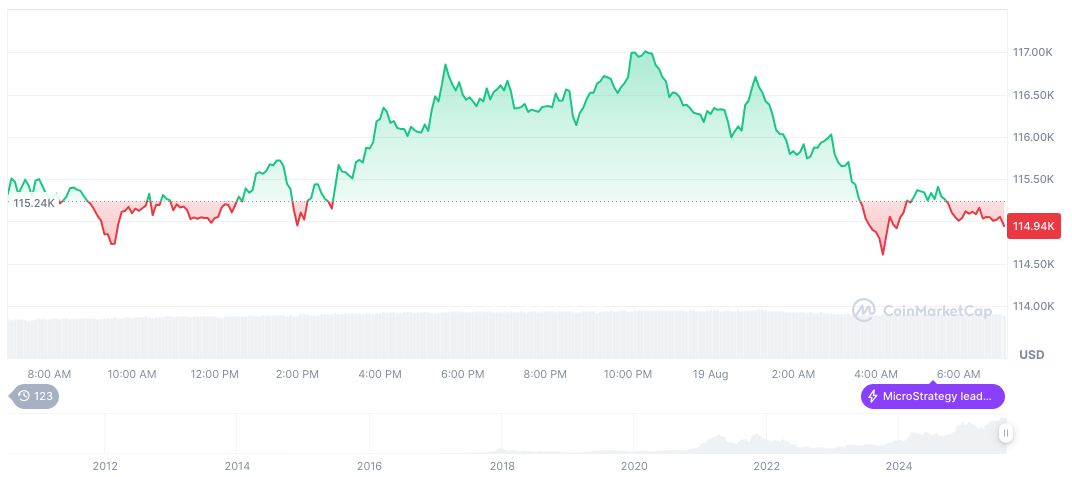

Bitcoin (BTC), priced at $115,539.62 with a market cap of $2.30 trillion, dominates the market at 58.89% per CoinMarketCap. Recent 24-hour trading volume was $63.43 billion, down 1.49%. The asset has shown slight fluctuations, increasing by 0.47% over 24 hours but declining 2.49% over the past week.

Coincu’s research team notes the potential impacts of Federal Reserve leadership changes on regulatory and financial climates, highlighting how interest rate movements could shape market dynamics. Powerful monetary shifts can lead to notable reactions in crypto adoption and development trends, heralding critical regulatory implications and aligning with historical precedents seen in previous chair changes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/bessent-leads-fed-chair-search/