- ARK Invest disclosed major holdings in Tesla, Roku, and Coinbase.

- Tesla holds the largest share at 10.28%.

- No significant changes for Bitcoin or Ethereum market price observed.

Ark Invest’s recent holdings disclosure reveals Tesla, Roku, and Coinbase as top positions in its ARK Innovation ETF as of August 15, 2025, according to official sources.

These portfolio choices underscore Ark’s continued investment in innovation-driven firms, impacting market perceptions of Tesla and Coinbase, though no immediate blockchain shifts are observed.

ARK Innovation ETF: Tesla, Roku, Coinbase Dominance

In a strategic move, ARK Investment Management, led by Cathie Wood, revealed updates to its ARK Innovation ETF. The disclosed holdings from August 15, 2025, highlight allocations in major tech and crypto-related companies. Tesla, with 10.28%, tops the list, followed by Roku at 6.45%, and Coinbase at 6.28%. This reshuffling showcases ARK’s optimistic stance on disruptive technology and digital currency ecosystems.

The ETF’s realignment may bring heightened attention to these assets in both traditional markets and the digital asset sector. While much focus is on Tesla’s dominance, the firm’s continued support of Coinbase emphasizes confidence in the crypto market infrastructure. Notably, no immediate on-chain changes were detected for BTC or ETH prices following this announcement.

Market reactions have been muted, with stakeholders watching for potential longer-term implications. Elon Musk, CEO of Tesla, has made no public comments about their inclusion or weighting in ARK’s ETF during this recent rebalancing. Similarly, Brian Armstrong, CEO of Coinbase, has not issued official statements regarding this specific ARK ETF update. Regulatory bodies like the SEC have also not issued statements relating to the ARK ETF update, maintaining a low-profile response.

Potential Regulatory Influence on Tech-Heavy Investment Strategies

Did you know? In previous ARKK rebalances, no significant long-term crypto price changes were directly attributed to individual equity shifts, highlighting a pattern of short-term market movements rather than permanent alterations.

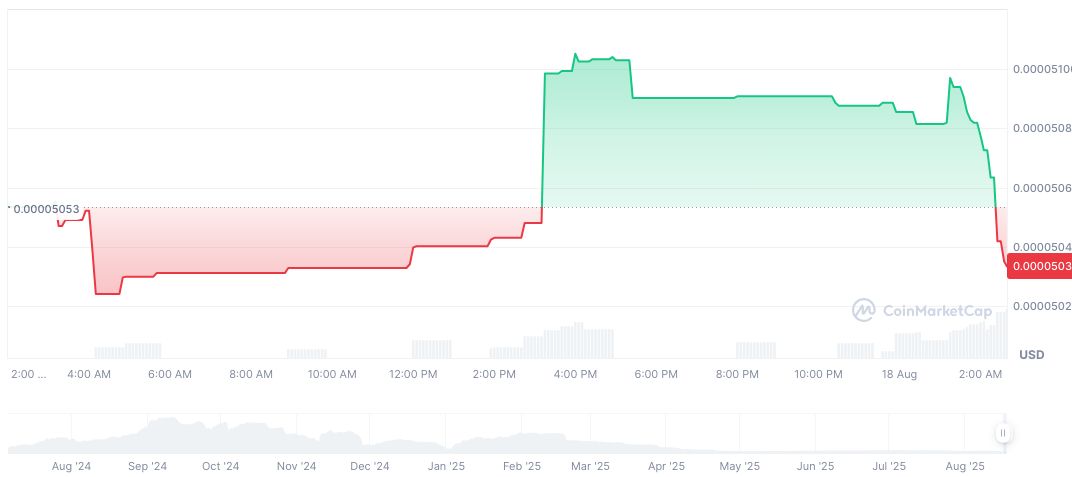

According to CoinMarketCap, 8-Bit Coin, symbol COIN, reported a price of $0.00 at the time of reporting. Its market cap stands at approximately $1.51 million, with a fully diluted market cap of $5.04 million. Trading activity in the past 24 hours was minimal, reflecting a 0.00% change. Over the past 30 days, COIN experienced a decrease of 24.59%, highlighting volatility.

Analysis from the Coincu research team suggests that ARKK’s focus on technology-forward companies may result in strengthened investor confidence in the digital asset realm. However, immediate financial fluctuations seem unlikely without new fundamental catalysts. A quote from Cathie Wood, Founder and Chief Investment Officer at ARK Investment Management, states, “Bitcoin is the reserve currency of the digital ecosystem” and a “flight to safety” in crypto crashes. Future regulatory responses could shape how such allocations influence broader market trends.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/ark-invest-etf-update-tech/