- Tiger Global acquires Circle shares, Q2 2025 SEC filing shows investment.

- Significant market move; highlights Circle’s stock performance increase.

- No official comments from SEC, Tiger Global, or Circle leadership.

Tiger Global Management reported a 28.2% increase in Q2 2025 holdings, including 125,000 shares of Circle, per an unverified SEC filing.

The substantial portfolio enhancement highlights Tiger Global’s strategic interest in digital assets amidst Circle’s robust stock performance.

Tiger Global’s $34.1 Billion Portfolio Boosts Market Confidence

Tiger Global Management’s Q2 2025 filing submitted to the SEC showcases a strategic purchase of 125,000 shares in Circle. This acquisition signals an increased commitment to the emerging financial technology sector. With a notable rise in Circle’s stock value since its public offering in June, this move has captured market attention. Tiger Global’s portfolio increase to $34.1 billion underlines a strong quarterly performance, representing a 28.2% rise from $26.6 billion. Market observers are closely monitoring reactions from institutional investors, despite the lack of official statements from Tiger Global or Circle executives.

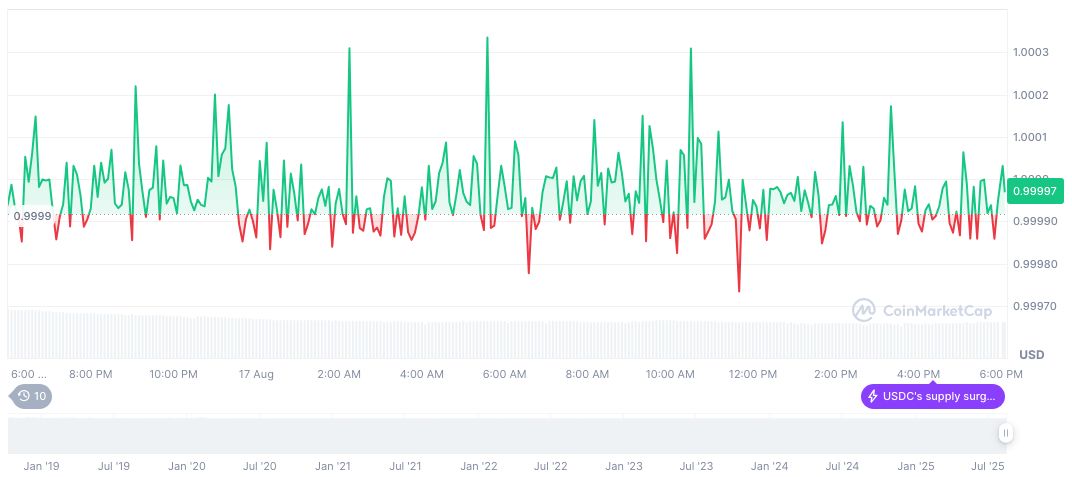

According to CoinMarketCap, USDC maintains a stable price of $1.00 with a market cap of $68.17 billion. Despite a 25.58% decrease in trading volume over 24 hours, there are stable price changes: a slight decrease of 0.01% in 24 hours and an increase of 1.30% over 90 days. The circulating supply stands at 68.17 billion USDC, as of August 17, 2025.

As of the information available up to August 17, 2025, there are no confirmed quotes or direct statements from key players regarding the specific event of Tiger Global’s 13F filing for Q2 2025 and its acquisition of Circle (CRCL.US) equities. Notably, institutions such as Tiger Global, Circle, and the SEC have not released any announcements that could serve as formal quotes.

Circle’s Market Evolution and Regulatory Implications

Did you know? Circle, the issuer of USDC, has seen a significant stock value increase, highlighting investor confidence in stablecoin issuers during fluctuating market conditions.

The Coincu research team speculates that Tiger Global’s investment decisions could steer more capital flow towards established fintech and stablecoin entities. Analysts also note potential regulatory shifts, with these investments possibly prompting tighter scrutiny of stablecoin issuers.

Despite the lack of official comments from involved parties, the market remains vigilant regarding the implications of this acquisition on future investment strategies and regulatory frameworks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tiger-global-circle-investment/