- S&P DJI plans blockchain tokenization for major indices, expanding investor access.

- Potential $370 million market impact foreseen.

- New product could transform institutional financial landscapes.

S&P Dow Jones Indices is collaborating with major exchanges and DeFi protocols to launch tokenized index products, including the S&P 500 and Dow Jones, enhancing blockchain-native exposure.

This initiative aims to increase access and liquidity for investors, integrating decentralized finance with traditional financial benchmarks, and potentially influencing market dynamics significantly.

S&P DJI and Centrifuge to Transform Indices via Blockchain

S&P DJI, in association with Centrifuge and asset managers, is seeking to tokenize large-scale benchmarks, facilitating blockchain-native market exposure. This strategic alignment could provide increased liquidity and investor access. Centrifuge, known for decentralized asset solutions, previously collaborated with S&P DJI to bring tokenization to real-world assets.

The anticipated changes aim to enable real-time, automated portfolios capable of 24/7 execution. This new approach leverages blockchain’s transparency and programmability, influencing traditional financial networks. Cameron Drinkwater of S&P DJI highlighted these developments:

“Our mission is to bring trusted benchmarks to every investor, today and tomorrow. Today’s announcement places The 500™ at the forefront of index tokenization and real-world asset integration and brings the innovation of decentralized infrastructure to the most iconic financial index in the world… The potential from here—real-time, programmable, automated, and 24/7 indexed portfolio solutions—is incredibly exciting.”

Blockchain Tokenization: A Game Changer for Finance

Did you know? The tokenization effort by giants like S&P DJI indicates a pivotal point where traditional finance meets decentralized technology, reinforcing blockchain’s potential to reshape financial landscapes.

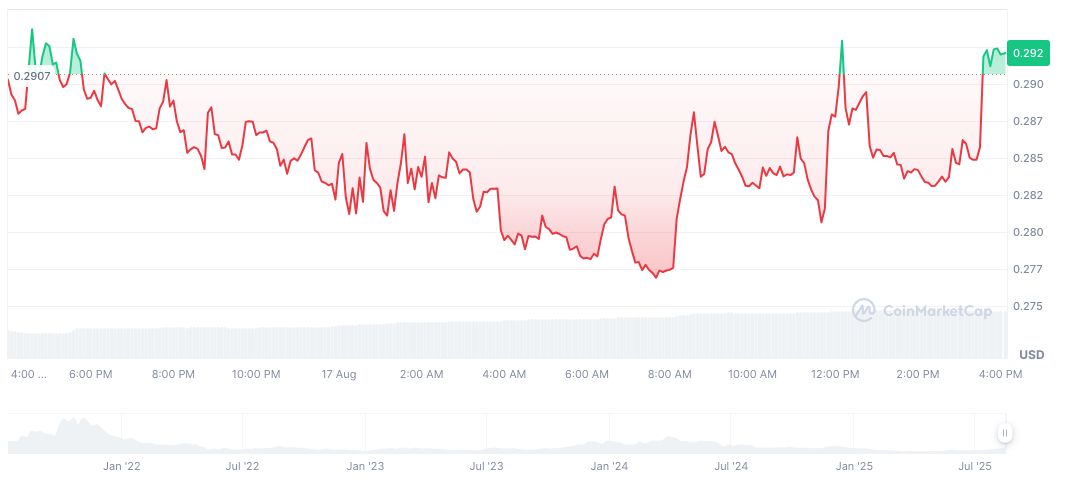

Centrifuge showcases dynamic price activity. Currently priced at $0.29, its market cap stands at $164.56 million. Over the last 90 days, it witnessed a 50.18% increase. Daily trading volume has surged by 69.82%, reaching $4.41 million (Source: CoinMarketCap).

Coincu’s research suggests potential regulatory frameworks will adapt to these innovations, potentially leading to wider industry adoption. Tokenization promises enhanced liquidity solutions, signaling a transformative moment in financial technology. Industry insiders closely monitor these developments, expecting profound implications for future asset management.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/sp-dji-tokenized-indices/