- Fear and Greed Index indicates market greed at 64, affecting BTC and ETH.

- Bitcoin reaches $118,000, Ethereum sees 1.05% decline.

- Market sees $175 million in liquidations, ETF outflows increase.

On August 17, 2025, the cryptocurrency Fear and Greed Index rose to 64, signaling heightened market optimism, impacting major cryptocurrencies Bitcoin and Ethereum.

This index rise, often linked to price rallies, signals potential volatility and liquidation risks, emphasizing the need for investor awareness and strategic caution.

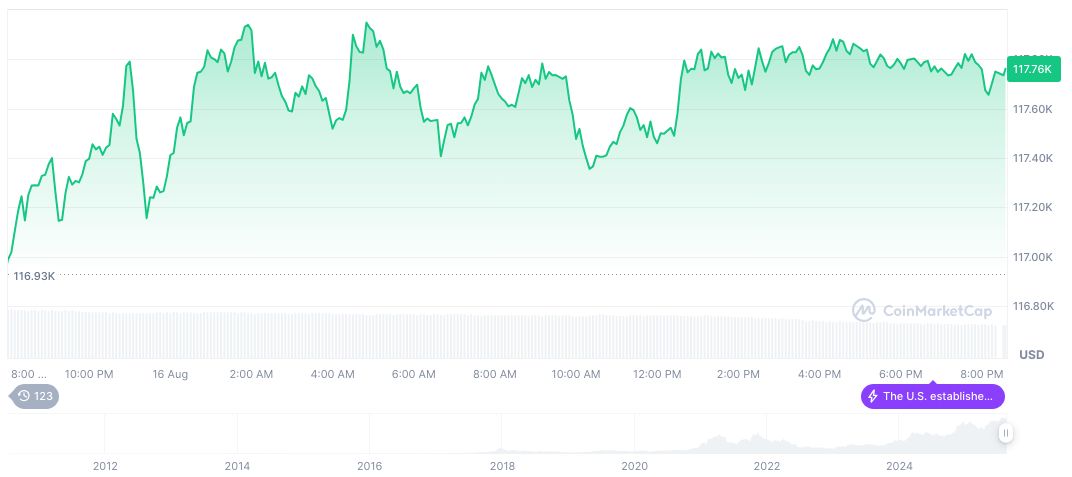

Bitcoin Spikes Past $118,000 Amid Rising Greed Indicators

Bitcoin and Ethereum, the primary assets impacted, showed considerable price changes amid rising greed levels in the market. Bitcoin’s value ascended to over $118,000, while Ethereum experienced fluctuations dipping below $4,400 before recovering.

The rise in market greed has led to sharp adjustments in trading behaviors, impacting a wide array of cryptocurrencies with ETF outflows rising. Bitcoin ETF outflows reached $14.01 million and Ethereum ETF saw outflows of $59.30 million.

While industry leaders like CZ Zhao and Vitalik Buterin have not publicly commented, the community remains attentive to potential shifts in market dynamics. Additionally, the day observed $175 million in liquidations, bringing attention to asset volatility and adjusted trading strategies.

Market Liquidations and ETF Outflows Reach $175 Million

Did you know? Historical data indicates that market greed spikes, like today’s, often precede abrupt liquidations and price rallies, impacting BTC and ETH trading behaviors significantly.

Bitcoin (BTC) currently trades at $118,028.03 with a market dominance of 58.73%, as reported by CoinMarketCap. BTC’s market cap stands at $2.35 trillion, while the 24-hour volume is $47.16 billion, a 26.69% decrease. Its 60-day price change reflects a 12.48% increase.

Coincu’s research team notes potential financial impacts arising from persistent market greed. This may catalyze short-term asset rallies alongside possible regulatory scrutiny. The historical trends suggest similar sentiment shifts often correlate with sharp market corrections and investor uncertainty.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-fear-index-rise-august-17-2025/