- Norges Bank increases Bitcoin-related holdings by 83% in Q2 2025.

- Investment primarily through MicroStrategy stocks.

- Actions highlight growing institutional interest in Bitcoin.

Norges Bank Investment Management, the world’s largest sovereign wealth fund, increased its bitcoin-related holdings by 83% in Q2, enhancing exposure primarily through MicroStrategy and Metaplanet assets.

This strategic move by a conservative state fund highlights a growing institutional interest in Bitcoin, potentially influencing other large-scale investors to reassess their crypto engagement strategies.

Norges Bank’s 83% Bitcoin Exposure Surge via MicroStrategy

Norges Bank Investment Management (NBIM), the world’s largest sovereign wealth fund, has increased its Bitcoin-related holdings by 83% in the second quarter of 2025. The fund chose to enhance its exposure from approximately 6,200 BTC to 11,400 BTC equivalents, primarily through investments in MicroStrategy shares and Metaplanet.

Industry reactions have been largely positive, with some market observers viewing this as further evidence of institutional adoption of digital assets. Geoffrey Kendrick from Standard Chartered highlighted that NBIM’s actions could prompt other funds to follow suit.

Geoffrey Kendrick, Global Head of Digital Asset Research, Standard Chartered, remarked, “The point here is that Norges is using MSTR as a way to gain exposure to the underlying. The increase in one quarter (83%) has to be a proactive position.”

Bitcoin’s Market Position and Institutional Influence in 2025

Did you know? Norges Bank’s use of MicroStrategy shares as a proxy for Bitcoin exposure is reminiscent of similar strategies adopted by other major institutional investors like BlackRock in previous market cycles.

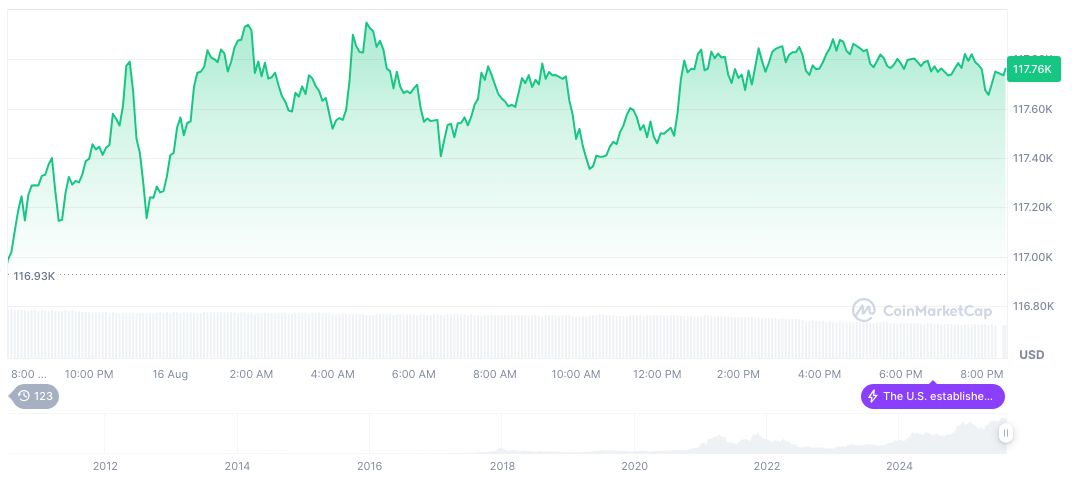

Bitcoin’s current price stands at $117,670.79 with a market cap of $2.34 trillion, according to CoinMarketCap. The market dominance is at 58.84%, and recent data indicates a modest decrease in price, with a 0.02% drop in the past 24 hours.

Coincu Research analysis suggests that NBIM’s increased involvement represents a major institutional interest in digital assets, potentially catalyzing further adoption and raising Bitcoin’s profile in the investment community. This trend could drive regulatory conversations on sovereign wealth fund participation in cryptocurrency markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/norwegian-wealth-fund-bitcoin-increase/