- Tiger Global acquires 125,000 Class A shares in Circle.

- Circle’s market cap soared, but reported a Q2 loss.

- USDC stability vital amid changing crypto market dynamics.

Tiger Global Management’s second-quarter report reveals a new acquisition of 125,000 Circle Class A shares, signaling a renewed focus on fintech investments as of June 2025.

The acquisition highlights increased institutional interest in stablecoins, impacting USDC’s market trajectory while raising interest in Circle’s regulatory-compliant offerings, despite reported financial losses this quarter.

Tiger Global’s Strategic Circle Acquisition Boosts Market Confidence

The acquisition signaled a strategic pivot towards fintech assets, reinforcing Circle’s market credibility. Circle, the USDC stablecoin issuer, has experienced increased market capitalization despite reporting financial losses due to volatile market dynamics and expanding regulatory pressures.

The crypto community has shown positive sentiment due to Circle’s advancing market cap. While Tiger Global did not publicly comment on the investment, financial analysts highlight the market validation that institutional investments bring to stablecoins and related infrastructures. As noted by a Financial Reporter, “Tiger Global’s decision to boost its stakes in major tech companies and new investments in fintech indicates a risk-on tone in their portfolio strategy.”

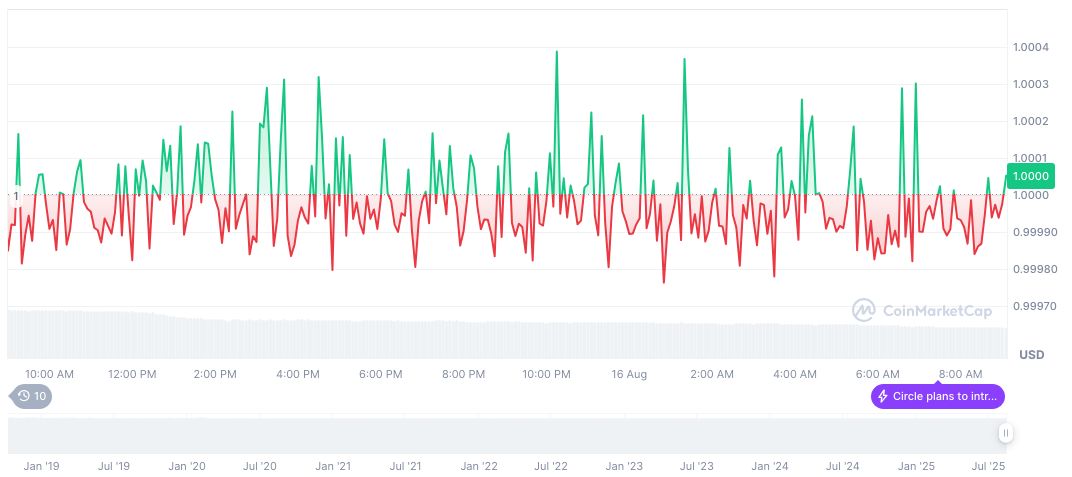

According to CoinMarketCap, USDC’s price held steady at $1.00, with a market cap of $68,173,963,910 USD. Its declining 24-hour trading volume reflects investor caution. Marginal price fluctuations persist, though USDC maintains robust market dominance.

Tiger Global’s Investment Influences USDC and Regulatory Scrutiny

Did you know? In 2023, crypto-exposed equity purchases by funds like Tiger Global historically increased short-term inflows into related DeFi assets, similar to Coinbase’s post-IPO effects on the market.

Coincu research indicates that Tiger Global’s Circle acquisition could prompt regulatory interest and boost fintech stocks. The research team suggests monitoring on-chain USDC activity and fintech regulatory developments to assess potential impacts on the market landscape. Circle’s recent efforts to speed up cross-chain transfers highlight its proactive stance in adapting to market needs.

Overall, the strategic investment by Tiger Global in Circle not only enhances Circle’s market position but also reflects broader trends in the fintech sector, emphasizing the importance of stablecoins in the evolving cryptocurrency landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tiger-global-buys-circle-shares/