- U.S. tariff litigation focuses on fiscal impact amid appealing tariffs.

- Growing revenue complicates potential Supreme Court ruling.

- Market reaction remains uncertain, with macroeconomic implications.

U.S. Treasury Secretary Benson remarked on Fox Business that as tariff revenue increases, potential Supreme Court rulings may lean in favor of the Trump administration, impacting global trade laws.

This remark highlights the financial rationale behind contentious tariffs and the ongoing legal challenges which could reshape economic dynamics between the U.S. and major trading partners.

Tariff Revenues Hit $27 Billion as Legal Challenges Mount

U.S. Treasury Secretary Benson stated that the continuation of tariff revenues complicates the Supreme Court’s ability to rule against the administration. This comment follows tariffs challenged in the Washington, D.C. Circuit Court, focusing on the legality of Trump’s reciprocal tariffs and newer duties on imports from China, Canada, and Mexico. President Trump’s extension of the U.S.-China tariff truce by 90 days as of August 12, 2025, highlights executive authority in tariff enforcement.

Primary financial implications arise from growing tariff collections, with fiscal revenue poised to hit unprecedented levels. As of July 2025, monthly collection reached $27 billion, contributing to a projected $2.8 trillion impact on U.S. federal deficits over a decade. “The increase in tariff revenues is projected to reduce total federal deficits by $2.8 trillion over the next decade, contingent upon successful litigation outcomes,” noted the U.S. Congressional Budget Office. High tariffs influence liquidity bases and could stoke macroeconomic uncertainty, thus prompting speculative safe-haven shifts in asset allocations.

Market reactions to this legal event are watchful, with officials like Janet Yellen cited as respondents in litigations. Despite the absence of definitive judicial decisions, analysts see potential interest in digital currencies and stablecoin frameworks. Community sentiment remains tentative, awaiting further developments.

Potential Crypto Impact Amid Fiscal Uncertainty

Did you know? The increase in tariff revenues is projected to reduce total federal deficits significantly over the next decade.

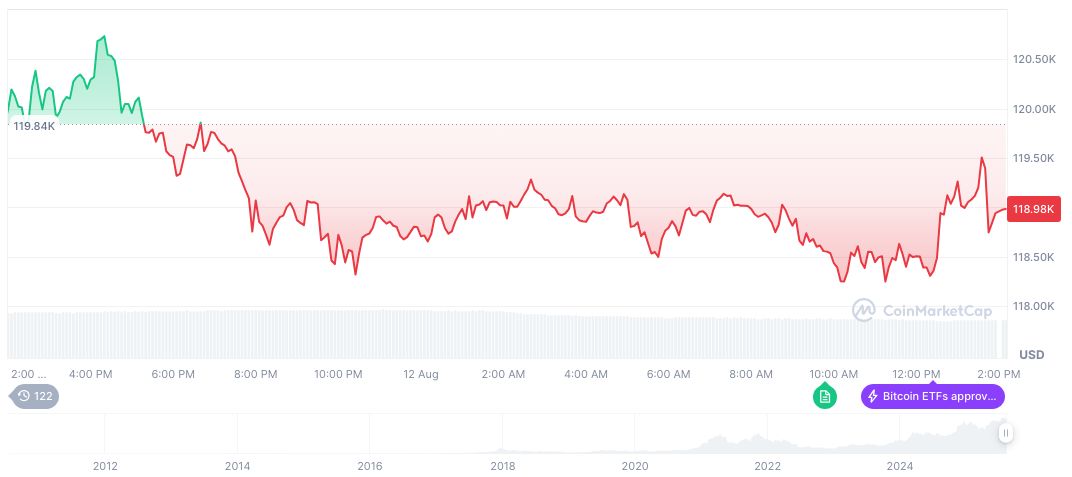

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $119,209.06 with a market cap of $2.37 trillion and dominance of 58.68%. Over the past 90 days, BTC appreciated by 16.12%, reflecting market resilience amid ongoing fiscal dialogues.

Research from Coincu suggests potential regulatory outcomes tied to tariff litigations may induce strategic pivots in macroeconomic policy, leveraging historically rising revenues to address deficit challenges. The gradual shift in national policy landscapes is expected to influence broader financial ecosystems.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/us-tariff-litigation-supreme-court/