- Key Point 1

- Key Point 2

- Key Point 3

July’s CPI data, hotter than expected, alters the calculus for a September rate cut, Wall Street Journal’s Nick Timiraos reported, reflecting on financial markets’ immediate reactions.

Market uncertainty persists as data suggests a rate cut delay, impacting crypto valuations like Bitcoin and Ethereum, with their prices stabilizing after initial volatility.

CPI Data Casts Doubt on September Rate Cut

Nick Timiraos, Wall Street Journal’s chief economics correspondent, revealed that the July Consumer Price Index (CPI) results have impacted expectations for a rate cut by the Federal Reserve in September.

July’s CPI data came in hotter than expected, complicating the prospects for interest rate reductions, though upcoming PPI and labor reports may still influence this decision.

“July CPI was hotter than expected on the core measures the Fed watches most closely, pushing back the threshold for a September rate cut; however, this alone may not be enough to rule it out, with PPI and jobs still to come.” — Nick Timiraos, Chief Economics Correspondent, Wall Street Journal

Crypto Markets Steady Amid Inflation Concerns

Did you know? The last time CPI data came in unexpectedly high, markets demonstrated a similar short-term volatility. Historical precedents show a reversion to stability once subsequent data clarified monetary policy direction. This pattern underscores the importance of continued market vigilance.

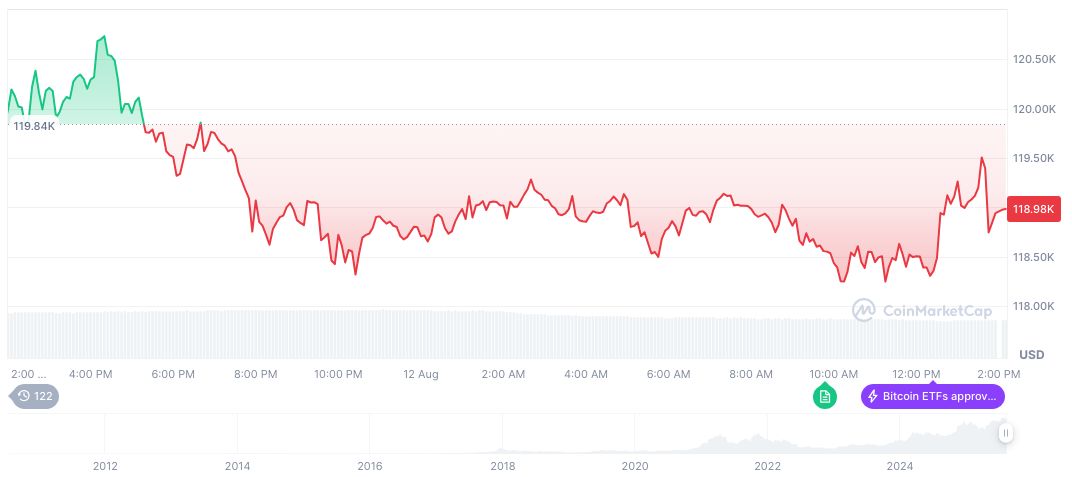

Bitcoin (BTC), currently priced at $119,815.53, holds a market cap of 2.38 trillion USD as of 21:57 UTC on August 12, 2025. Markets experienced a 1.03% rise over the past 24 hours, indicative of resilient market behavior amid anticipated rate shifts. Over the past 90 days, Bitcoin has appreciated 15.63%. These statistics reflect data sourced from CoinMarketCap.

Coincu’s research team emphasizes the impact of macroeconomic factors. Regulatory actions and technological advancements will remain pivotal in shaping financial landscapes. Historical data suggests that verified inflation control could stabilize markets over time, restoring investor confidence in both traditional and cryptocurrency realms.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/fed-rate-cut-inflation-impact/