- Scott Chronert increases S&P 500 target to 6600.

- Potential U.S. tax cuts seen as offset to tariff impacts.

- Market outlook is positive, but investor caution remains.

Citigroup’s strategist Scott Chronert suggested that potential U.S. tax cuts might counteract the negative effects of tariffs, but details on a specific S&P 500 target date remain unconfirmed.

This stance reflects a cautious market approach, where corporate earnings face pressure from tariffs, yet hope persists for tax policies to boost equities by year-end.

Impact of Tax Cuts on S&P 500 Outlook

Scott Chronert’s team at Citigroup adjusted the S&P 500 target, suggesting an improved outlook due to potential tax cuts. The revised target moved to 6600 from the initial 6300, reflecting anticipated economic changes.

The primary change centers on offsetting tariff effects through tax cuts, highlighting Citigroup’s optimistic view. However, the absence of a formal note leaves parts of this update open to verification.

While Citigroup’s stance is optimistic, investor reactions are varied amid economic uncertainties. Chronert emphasized policy impacts in previous statements, underscoring the importance of monitoring fiscal developments.

Bitcoin Surge and Fiscal Policy Implications

Did you know? Despite the lack of formal confirmation, Citigroup adjusting the S&P 500 target echoes historical market responses to potential tax cuts mitigating tariff impacts.

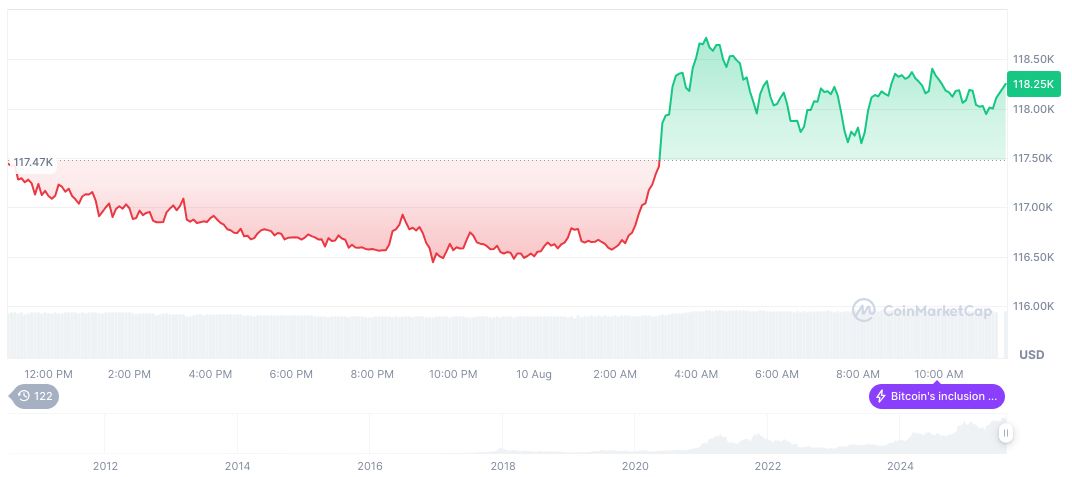

As of August 11, 2025, Bitcoin (BTC) is priced at $121,156.49 with a market cap of $2.41 trillion, capturing 59.94% dominance. Data from CoinMarketCap highlights a 24-hour trading volume of $78.66 billion, reflecting a 33.52% change, alongside a 2.65% price increase over the same period.

The Coincu research team suggests that U.S. fiscal policy shifts, such as tax cuts, may influence broader financial markets, potentially catalyzing favorable market conditions. Historical data underscores the volatility linked to fiscal decisions and tariff policies. Scott Chronert, Managing Director, U.S. Equity Strategist, Global Head of ETF Strategy & Analysis at Citi Research, stated, “tariffs vs. tax cuts are central to S&P 500 trajectory” reinforcing the outlook of policy paths as key factors affecting equities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/citigroup-sp500-target-6600/