- Bitcoin approaches its all-time high as traders anticipate U.S. CPI data.

- Crypto markets align with rising risk appetite in equities.

- Increased Bitcoin put options signal hedging ahead of CPI release.

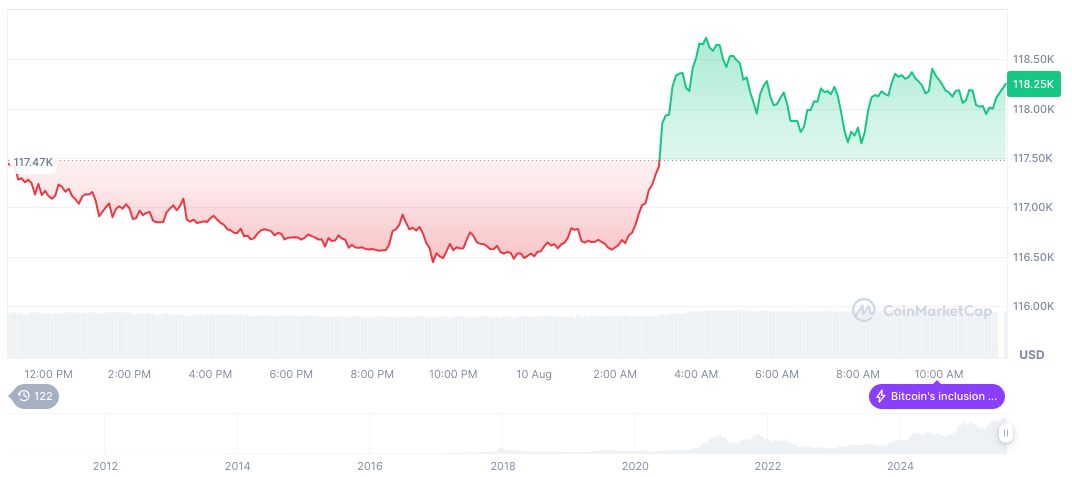

Over the low-liquidity weekend, Bitcoin surged past $122,000, approaching its all-time high. Ethereum also gained 21%, signaling growing optimism in the cryptocurrency market, reported QCP Capital.

Traders are closely watching Tuesday’s U.S. CPI release, with potential Fed rate cuts influencing crypto volatility, as Bitcoin sees increased options market activity for downside protection.

Crypto Surge as Traders Eye U.S. Inflation Data

The recent increase in Bitcoin and Ethereum prices occurred during a period of reduced market liquidity. QCP Capital, a Singapore-based trading firm, highlighted that Bitcoin surpassed $122,000 and Ethereum broke through $4,300. The crypto market’s activities align with the broader risk-on sentiment, as U.S. equities also showed gains despite macroeconomic uncertainties.

The U.S. CPI data release, scheduled for Tuesday, is at the forefront of traders’ concerns. Market expectations suggest a possible 10 basis point rise in the year-on-year inflation rate to 2.8%. A lower-than-expected CPI could cement expectations of a Federal Reserve rate cut.

A notable reaction came from the options market where traders are hedging potential risks with Bitcoin put options in the $115,000 to $118,000 range. Meanwhile, call options showing continued buy interest indicate mixed expectations. Federal Reserve officials have recently made dovish remarks, suggesting potential rate cuts, further impacting market sentiment.

“We are seeing clear disinflation progress and can consider rate cuts if the trend persists.” — Federal Reserve Official, U.S. Federal Reserve

Bitcoin and Ethereum: Market Insights and Price Movements

Did you know? Previous CPI data releases have historically triggered short-lived spikes in Bitcoin’s implied volatility. Market participants often position for both upside and downside risks ahead of such key economic indicators, reflecting a consistent approach to navigating potential market impacts.

Bitcoin is currently priced at $121,163.83, possessing a market capitalization of $2.41 trillion. With a market dominance of 59.92% and a fully diluted market cap of $2.54 trillion, Bitcoin’s 24-hour trading volume is $77.96 billion, up 27.91%. Recent price changes include a rise of 2.50% over 24 hours and a 7-day increase of 5.92%, as data from CoinMarketCap indicates.

According to the Coincu research team, the interaction between Federal Reserve policy shifts and crypto market responses is pivotal. If rates are cut following acceptable CPI data, institutional interest might increase, potentially driving prices higher. Regulatory measures, however, remain a crucial variable influencing mid-term market strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitcoin-ethereum-cpi-fed-rate-cuts/