- Renewed interest in U.S. large-cap tech by fund managers.

- Economic hard landing risk drops to lowest since January 2025.

- Expectations for interest rate cuts within 12 months.

In August, Bank of America’s survey revealed a shift as investors favored U.S. large-cap tech stocks, driven by positive earnings and improving global economic sentiment.

This trend highlights a renewed risk appetite, potentially enhancing crypto markets like BTC and ETH, amid expectations of rate cuts within the next year.

U.S. Large-Cap Tech Stocks Capture Fund Managers’ Attention

August survey results from Bank of America reveal renewed interest among fund managers in U.S. large-cap tech stocks. The survey covered 169 managers with a combined oversight of more than $413 billion in assets, indicating a significant allocation shift. Michael Hartnett, Bank of America’s Chief Investment Strategist, is central to these findings, often tracking contrarian market positions. As he stated, “We are seeing renewed risk-on positioning into U.S. large-cap tech, with a net 78% of managers expecting rate cuts over the next 12 months.”

Changes expected from this survey include increased equity allocations, although not at extreme levels yet, and a steady decline in the perceived risk of an economic hard landing. This suggests an overall optimism about future earnings and economic recovery. A net 78% of participants forecast lower short-term interest rates within 12 months, anticipating potential monetary policy easing.

Market reactions align with survey data, highlighting a notable turning point in investment behaviors and risk sentiment. As Hartnett observed, the “most crowded trade” in the form of large-cap tech implies enhanced enthusiasm for mega-cap equities. Expectations of rate cuts and improved liquidity conditions could potentially spill over to other risk assets, including the cryptocurrency sector.

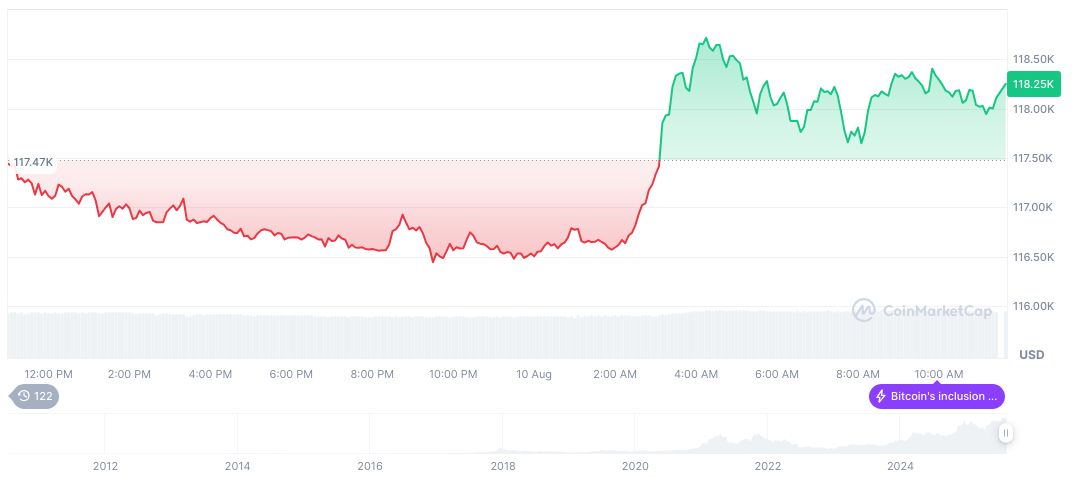

Bitcoin Price Soars Amid Optimistic Economic Outlook

Did you know? Historical FMS data shows that prior peaks in U.S. tech holding bouts, such as in 2017 and 2020, coincided with increased crypto performance during liquidity upswings, although correlations are not always direct.

According to CoinMarketCap, Bitcoin (BTC) is trading at $121,869.47, with a market cap of $2.43 trillion and a 24-hour trading volume of $77.21 billion, up 30.65%. Over the past 24 hours, BTC’s price rose 3.32%, continuing a growth trend evident over the past 90 days.

Coincu analysts point to potential long-term implications from this survey, emphasizing the interplay between equity markets and crypto sectors. With interest rate expectations trending downward, financial conditions are set to favor risk assets. This could see continued interest in high-beta cryptocurrencies like Bitcoin and Ethereum should liquidity conditions persist.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bank-survey-tech-stocks/