- Federal Reserve’s Bowman proposes interest rate cuts amid labor market weakness.

- Labor market concerns outweigh inflation risks.

- Potential positive impact on crypto markets.

Federal Reserve Governor Michelle Bowman proposed three interest rate cuts for 2025, attributing this shift to recent declines in U.S. job growth, as reported at the Kansas Bankers Association.

The anticipated rate cuts may influence global asset pricing, impacting cryptocurrencies like BTC and ETH, known for reacting positively to dovish Fed policies, enhancing risk sentiment.

Crypto Markets React to Fed’s Dovish Shift

In community and institutional circles, anticipation of rate cuts is rising. The crypto market historically responds positively to such shifts, with increased activity anticipated in digital assets like Bitcoin (BTC) and Ethereum (ETH). Although no official statements were found from leading crypto figures like Arthur Hayes or Raoul Pal, the sentiment among market participants is notably bullish.

The significant weakness in the labor market outweighs the risk of future inflation, and she expects to support rate cuts at all three remaining Fed meetings this year. — Michelle Bowman, Governor, US Federal Reserve

The significant weakness in the labor market outweighs the risk of future inflation, and she expects to support rate cuts at all three remaining Fed meetings this year. — Michelle Bowman, Governor, US Federal Reserve

Market Data and Future Insights

Did you know? A similar interest rate cut cycle from December 2018 to July 2019 resulted in Bitcoin’s price increasing nearly 4-fold, highlighting the positive historical correlation between interest rate reductions and cryptocurrency valuations.

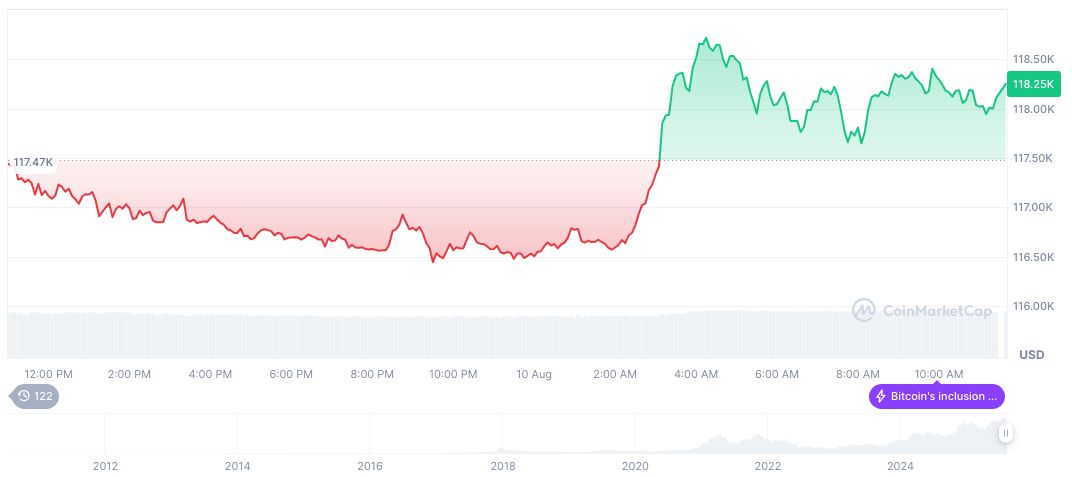

As of the last update, Bitcoin (BTC) is priced at $119,264.16 according to CoinMarketCap, with a market cap of $2.37 trillion and a market dominance of 59.56%. Recent price movements include a 2.31% increase over 24 hours and a 16.42% uptick over 90 days. The trading volume reached $64.14 billion, reflecting a 19.15% change.

Coincu Research suggests prolonged rate cuts could stimulate investment in crypto and blockchain ventures, fostering an expansion in DeFi protocols and layer 1 blockchain projects. As digital assets align with traditional financial markets, stakeholders closely watch the Fed’s next steps, balancing rate changes and economic variables.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-bowman-interest-rate-cuts/