- El Salvador licenses banks for Bitcoin services, attracting foreign investment.

- Regulation limits benefits primarily to institutions, not the public.

- Market impact uncertain as key figures suggest institutional bias.

Salvadoran Digital Assets Commission Chairman Juan Carlos Reyes confirmed a new law permitting licensed investment banks to hold digital assets, aiming to enhance El Salvador’s status as a financial hub.

The policy could boost foreign investment, though critics argue it favors institutions over individuals, influencing market dynamics and raising questions about equitable economic benefits.

El Salvador Grants Bitcoin Service Rights to Banks

El Salvador’s legislative move allows investment banks to pursue a Digital Asset Service Provider license, enabling them to manage digital assets like Bitcoin. This initiative is part of the government’s strategy to attract foreign investment and bolster its image as a hub for financial innovation.

Licensed banks can now operate with digital assets. This shift aims to demonstrate El Salvador’s commitment to digital financial services. However, critics argue that these benefits are skewed toward institutions while offering minimal advantages to the general public.

“The recent updates in El Salvador’s Investment Banking Law will allow licensed banks to engage in cryptocurrency business, paving the way for a more integrated financial landscape.” — Juan Carlos Reyes, Chairman of the Salvadoran Digital Assets Commission [Source: ChainCatcher Update]

Bitcoin’s Role in El Salvador’s Economic Strategy

Did you know? El Salvador’s betting on Bitcoin correlates with MicroStrategy’s earlier Bitcoin adoption strategy, marking a trend of significant institutional focus in cryptocurrency markets.

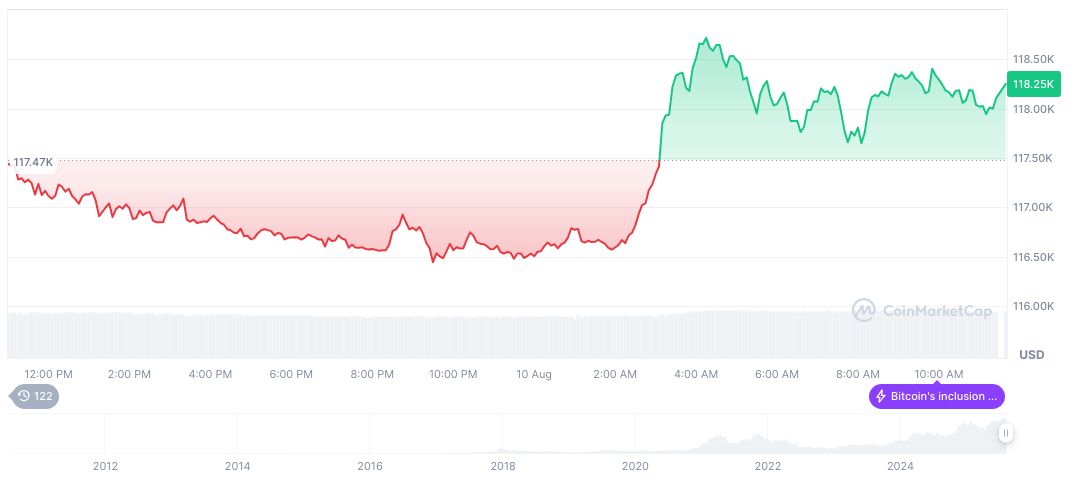

Bitcoin (BTC) is currently valued at $118,605.04, with a market cap of $2.36 trillion, and holds a 59.61% market dominance, according to CoinMarketCap. In the past 24 hours, Bitcoin’s trading volume reached $61.23 billion, a 9.50% increase. The currency saw a 1.48% price rise in the last day and a 15.27% increase over the past 90 days, with a circulating supply nearing its maximum at 19.9 million.

The research team at Coincu notes that the new regulations in El Salvador could accelerate Bitcoin’s institutional adoption within financial markets. While strategically enhancing the nation’s economic profile, this move might reinforce existing challenges related to public inclusion.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/el-salvador-bitcoin-banking-law/