- The “Stablecoin Regulation” became effective on August 1, 2025.

- Licensing required for stablecoin issuers under HKMA and SFC guidance.

- Several exchanges adapt or halt operations due to new rules.

On August 1, 2025, Hong Kong implemented a new stablecoin regulation requiring exchanges to cease USDT and USDC trading without a license, impacting several platforms.

The regulation affects market operations, liquidity in Hong Kong, with potential ripple effects on global stablecoin trading and compliance strategies.

Hong Kong’s Stablecoin Licensing Transforms Exchange Operations

The Hong Kong “Stablecoin Regulation” initiated on August 1, 2025, under the Hong Monetary Authority (HKMA) and Securities and Futures Commission’s (SFC) guidance, enforces a licensing system for stablecoin issuers. Exchanges facilitating USDT and USDC are mandated to comply or halt operations.

Licensing requirements include stringent capital thresholds, AML/CFT controls, and redemption guarantees. Exchanges like “One Bitcoin” and “5X Crypto” have suspended their USDT and USDC services due to these rules, with some closures such as “BitsMark” reported.

“Following the implementation of the regulatory regime for stablecoin issuers under the Stablecoins Ordinance on 1 August 2025, the business of issuance of fiat-referenced stablecoins is a regulated activity in Hong Kong and a licence is required.” – HKMA Official, Hong Kong Monetary Authority

Global Regulatory Impact as Hong Kong Enforces Licensing

Did you know? Similar regulatory initiatives in Singapore and Japan briefly shifted stablecoin trading to OTC and private sectors, echoing Hong Kong’s current regulatory impact.

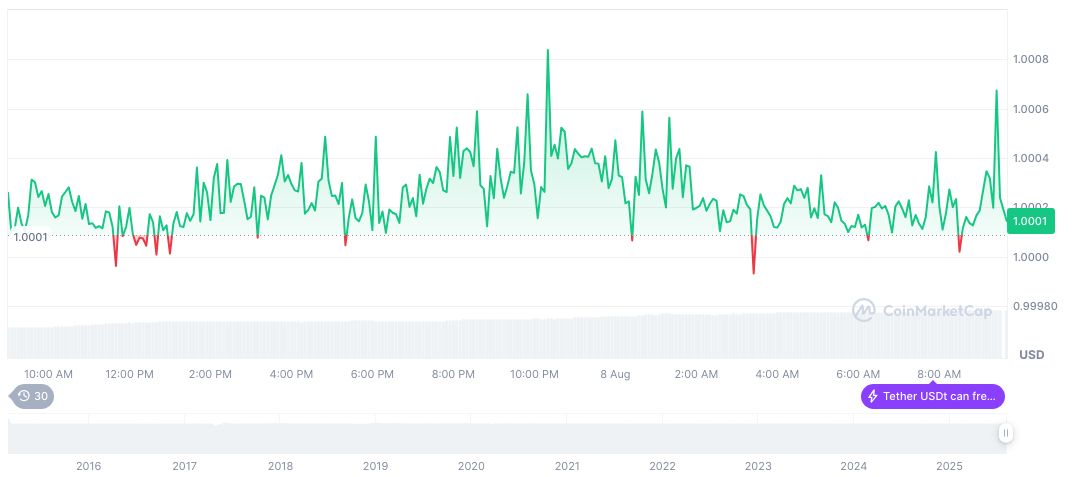

As of August 9, 2025, Tether (USDT) maintains a price of $1.00 with a market cap of $164.53 billion, holding 4.23% market dominance. Recent analytics show stable 24-hour trading volumes at $103.73 billion, despite a 14.84% decrease. Data via CoinMarketCap.

The Coincu research team summarizes that Hong Kong’s licensing shift could influence global regulatory approaches, enhancing compliance frameworks. Expect capital flows into compliant exchanges as regulatory clarity solidifies market trust.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-stablecoin-licensing-5/