- Trident Digital Tech Holdings plans to apply for stablecoin licenses in multiple African countries.

- The company aims to establish a $5 billion corporate XRP reserve.

- No public statements from Ripple executives or regulatory bodies on this initiative yet.

Trident Digital Tech Holdings, listed on Nasdaq, revealed plans to secure stablecoin licenses in Africa and establish a $5 billion XRP reserve, seeking Ripple ecosystem integration by 2026.

This move signifies an expansive strategic foothold in the digital currency market, though official confirmations from these countries and financial bodies are yet pending.

Key Developments, Impact, and Reactions

Trident Digital Tech Holdings announced its plan to apply for stablecoin licenses in multiple African countries and raise $5 billion for a corporate XRP reserve. The initiative seeks to boost integration with the Ripple ecosystem. The proposal is part of the company’s strategy to expand the usage of its stablecoin, RLUSD, within Africa.

As part of the strategy, the expected phased deployment in pilot countries by mid-2026 could reshape the economic and financial landscape within Africa, assuming regulatory and financial support align. The company’s move is a clear indication of the growing interest in cryptocurrency adoption in emerging markets.

As of August 8, 2025, there are no direct quotes related to the recent announcements from Trident Digital Tech Holdings regarding their plans for stablecoin operational licenses in Africa and the establishment of a $5 billion corporate XRP reserve pool. The executives have not made any public statements, which has been confirmed through various official sources.

XRP Market Dynamics and Historical Context

Did you know? MicroStrategy previously launched a large-scale BTC strategy, yet no similar action has been officially taken for XRP by a Nasdaq-listed company before Trident’s announced plan.

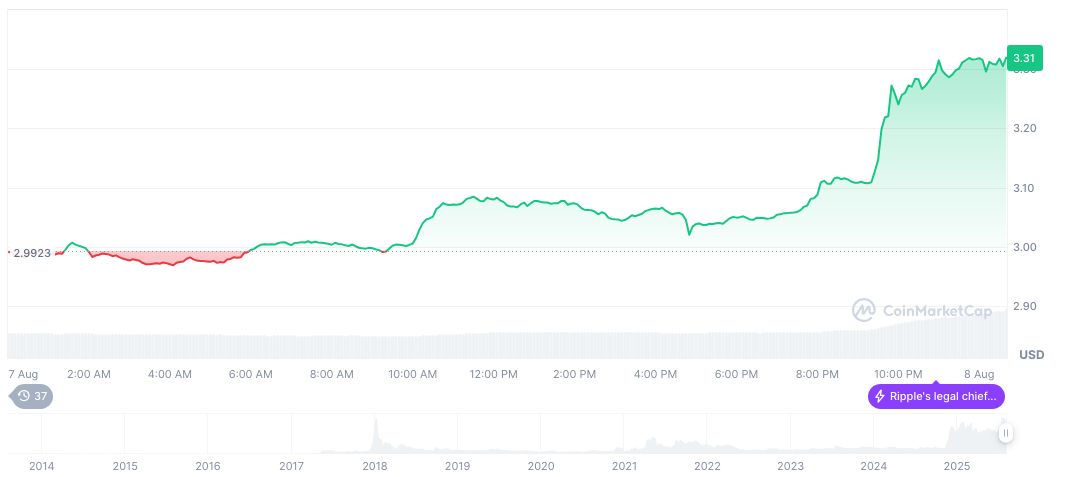

XRP’s current price is $3.28 with a market cap of $194.28 billion, representing a 4.99% dominance in the market. Trading volume in the past 24 hours has surged by 178.15% to $13.27 billion, reflecting increased market activity. Notable price changes include a 7.20% increase over 24 hours and 36.82% over 30 days, as sourced from CoinMarketCap.

Insights from the Coincu research team suggest that regulatory hurdles and technological maturation could heavily influence Trident’s strategic outcome. Historical trends point to the necessity of robust financial frameworks to avoid past crypto pitfalls, emphasizing synchronized efforts between tech firms and financial regulators.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/trident-africa-stablecoin-xrp-reserve/