- The US SEC has introduced Project Crypto aiming to lead in blockchain finance.

- Project aims to modernize regulations and foster domestic crypto growth.

- Expected impacts on crypto infrastructure and regulatory policies.

On July 31, 2025, SEC Chairman Paul S. Atkins launched ‘Project Crypto’ to modernize U.S. securities regulation, potentially positioning the nation as a leader in global blockchain finance.

This initiative signals a significant shift, aiming to revitalize American blockchain innovation and redefine regulatory policies, with anticipated impacts on institutional investment and crypto asset management strategies.

U.S. Seeks Blockchain Leadership Through Regulatory Overhaul

SEC Chairman Paul S. Atkins recently announced the launch of Project Crypto, focused on integrating blockchain technology into U.S. financial regulation. This initiative aims to modernize outdated systems and position the U.S. as a leader in blockchain finance.

The project explicitly targets regulatory clarity and alignment with global crypto trends, projecting an increase in domestic innovation. It marks a departure from previous strategies that viewed most crypto assets as securities, a shift aiming to ease compliance burdens.

Notably, market reactions have been reserved. During his speech, Atkins emphasized the potential for American leadership in digital finance. As Atkins stated, “We are at the threshold of a new era in the history of our markets. … The world is not waiting. America must do more than just keep pace with the digital asset revolution. We must drive it.” Despite this enthusiasm, official responses from major crypto figures are currently scarce as of the latest reports.

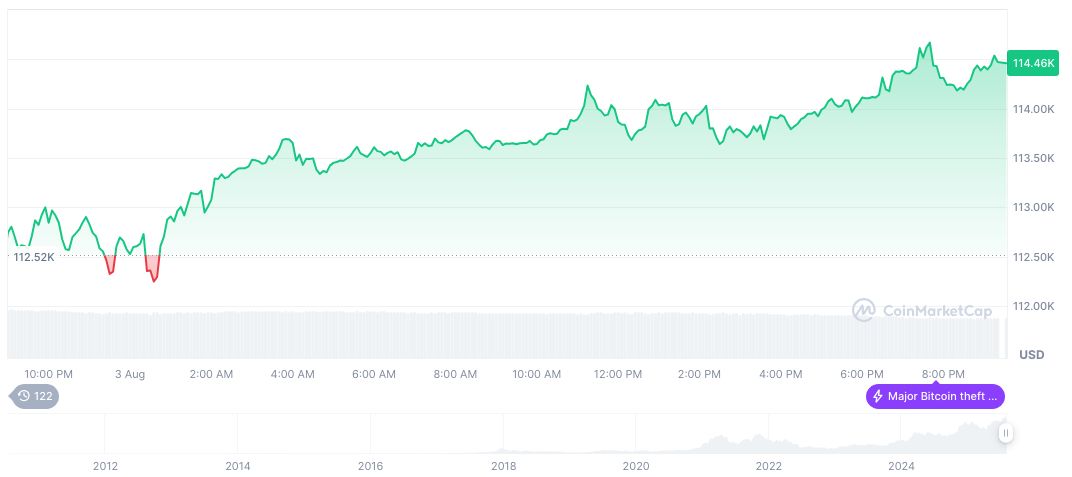

Bitcoin Hits $115k as Project Crypto Promises Clarity

Did you know? The launch of the SEC’s Project Crypto reflects a proactive regulatory stance, contrasting with decades of ambiguity around crypto, paralleling efforts by other nations to establish dominance in digital finance.

As reported by CoinMarketCap, Bitcoin (BTC) recently recorded a price of $115,522.24, with a market cap of $2.30 trillion. The 24-hour trading volume reached $55.16 billion, reflecting a slight daily increase. Over the past 90 days, Bitcoin’s price has climbed by 22%, highlighting significant short-term momentum.

Coincu’s research suggests the anticipated regulatory clarity from Project Crypto may encourage increased institutional participation. Historical patterns indicate that such regulatory initiatives often promote both technological advancements and renewed investor confidence in the blockchain domain.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/us-sec-project-crypto-blockchain/