- Capital B’s reported $13.3 million Bitcoin purchase lacks official confirmation.

- No primary source verifies the acquisition as of August 4, 2025.

- Strategy’s verified large Bitcoin purchase marks notable contrast.

European listed company Capital B reportedly announced a $13.3 million investment to enhance its Bitcoin holdings, as monitored by NLNico.

The absence of primary confirmations means Capital B’s influence and market impact remain speculative, contrasting with well-documented investments like Strategy’s significant BTC purchase.

Capital B’s Bitcoin Acquisition: Questions of Authenticity and Impact

Reports suggest Capital B has acquired Bitcoin totaling $13.3 million. This announcement has surfaced through secondary sources without corroborative filing or statement from the company.

This alleged purchase lacks confirmation from official sources, rendering its implications uncertain. No blockchain activity verifies Capital B’s transaction, contrasting with documented investments like Strategy’s acquisition of significant Bitcoin holdings.

The crypto community has expressed skepticism. Without primary reference from Capital B’s leadership or regulatory filings, the alleged investment’s legitimacy remains questionable. No institutional response or major crypto figure has acknowledged this report publicly.

No quotes or statements from the leadership of Capital B regarding the reported Bitcoin acquisition can be provided.

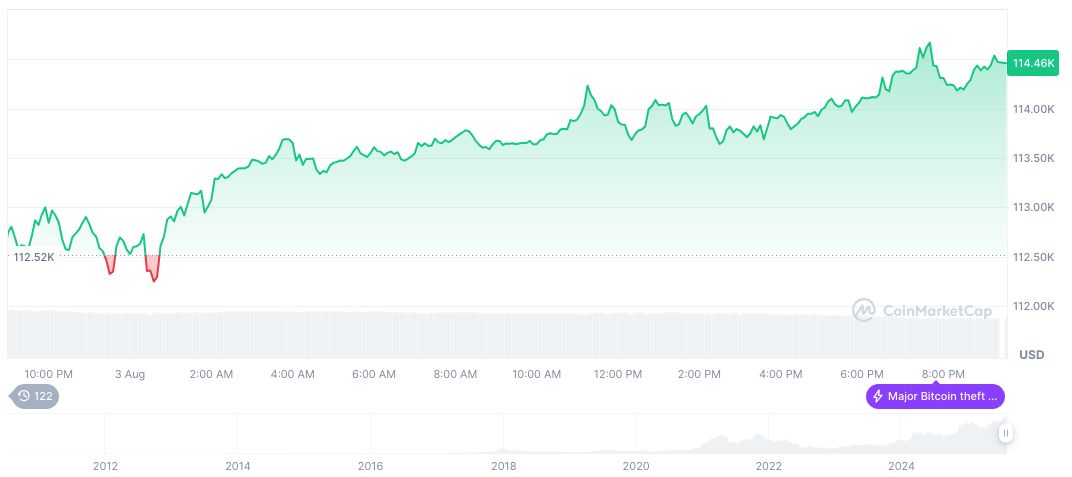

Market Context and Price Fluctuations as Bitcoin Trades at $114,518.18

Did you know? The lack of concrete evidence for Capital B’s claimed Bitcoin investment highlights the importance of official communications and blockchain verification in cryptocurrency markets.

As of August 4, 2025, Bitcoin trades at $114,518.18 with a market cap of $2.28 trillion, as reported by CoinMarketCap. Recent 24-hour price changes show a 0.74% increase amidst ongoing volatility. Market trends indicate a 21.29% price ascent over 90 days, while dominance stands at 61.21%.

Coincu’s research indicates the absence of verifiable data constrains Capital B’s potential digital asset influence. Historically, confirmed acquisitions involve transparent filings and official endorsements, crucial for sustained market trust.

Michael Saylor is a notable figure often associated with significant Bitcoin transactions. His impact on market perception parallels stories of large corporate investments in digital assets, albeit substantiated through more verified channels, as seen with Bitcoin trades and acquisitions on major exchanges like Coinbase and Binance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/capital-b-bitcoin-investment-unverified/