- HK stablecoin licensing regime launches, regulatory challenges surface for applicants.

- Non-financial entities may abandon stablecoin participation.

- Internet platforms face hurdles complying with requirements.

The Hong Kong Monetary Authority’s stablecoin licensing regime began on August 1, 2025, impacting stablecoin issuers who must now comply with stringent regulatory requirements.

These new rules could deter non-financial institutions from participation due to compliance challenges, affecting market dynamics and potentially hindering early adoption by major internet companies.

Hong Kong’s Licensing Requires Strict Compliance and Verification

Hong Kong’s stablecoin licensing regime is in effect, requiring issuers to adhere to strict identity verification and compliance measures. Sources suggest non-financial institutions might withdraw from early participation due to regulatory challenges.

The new regulations demand significant compliance costs, which might discourage major internet firms like JD.com and Ant Financial from applying for licenses. The rules might impact cross-border payment platforms currently enthusiastic about the stablecoin market Stablecoin issuer licensing in Hong Kong starts on August 1, 2025.

“The launch of the new Stablecoin Ordinance represents our commitment to establish Hong Kong as a global hub for fintech innovation while ensuring rigorous regulatory oversight.” — John Lee, Chief Executive, Hong Kong Government

Reactions from the community are subdued as official statements from affected companies are absent. Financial entities like CITIC Group have already initiated applications, indicating a shift towards formal compliance by potential market leaders Key amendments to Hong Kong’s stablecoin bill after legislative passage.

Financial Institutions Poised to Lead Amidst Regulatory Pressures

Did you know? The HKMA’s stablecoin regime is reminiscent of international regulatory strategies but includes unique measures like strict identity verifications, designed to bolster trust within Hong Kong’s financial marketplace.

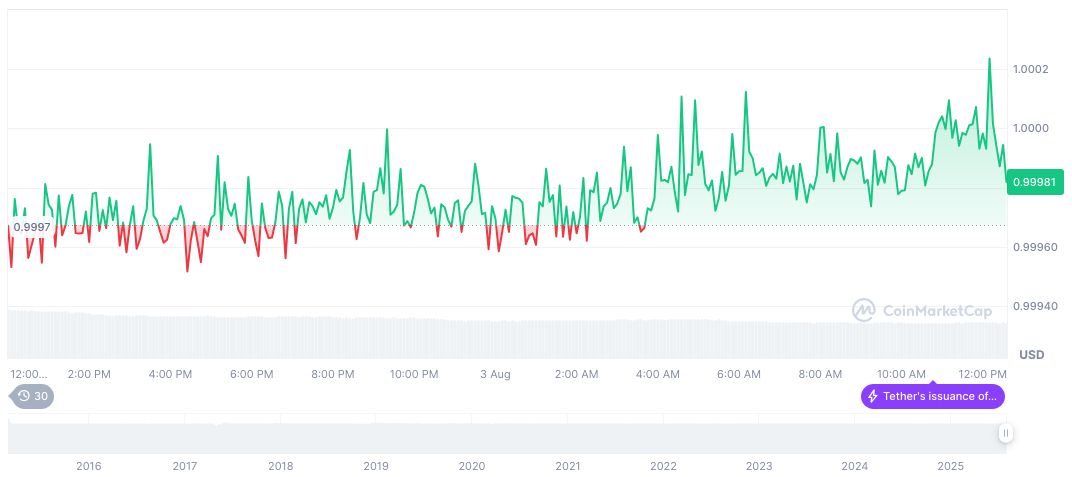

According to CoinMarketCap, Tether (USDT), valued at $1.00, exhibits minor variations with a 24-hour increase of 0.04%. The circulating supply stands at 163.89 billion USDT, emphasizing its stable market presence despite periodic regulatory adjustments.

Coincu’s research team anticipates that Hong Kong’s regulation will likely encourage financial institutions over tech giants to progress within the stablecoin environment, leveraging their structured adherence to robust regulatory practices Updates from HKMA regarding the new stablecoin regime.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-stablecoin-regulation-6/