- Berkshire Hathaway, led by Warren Buffett, sees consumer revenue decline due to tariffs.

- Consumer division revenue fell 5.1% amid sales and logistics challenges.

- Brooks Sports revenue increased by 18.4%, bucking overall decline.

Berkshire Hathaway reported a 5.1% revenue decline in its consumer goods division this second quarter, primarily due to U.S. import tariffs and restructuring impacts, affecting brands like Fruit of the Loom.

The results highlight ongoing challenges in global trade policies, reflecting broader economic repercussions and investor concerns amidst a volatile tariff landscape affecting supply chains and earnings.

Berkshire Faces 5.1% Revenue Drop Amid Tariffs

Berkshire Hathaway experienced a 5.1% revenue decline in its consumer goods division during the second quarter, as disclosed in recent filings. Elevated U.S. import tariffs and internal restructuring primarily drove this decrease, according to official sources.

The organization attributed logistics delays and reduced sales to the tariff policy, which also affected its consumer products portfolio. Strong performance in Brooks Sports, registering 18.4% growth, partially offset broader declines, highlighting sector-specific adaptations.

Warren Buffett, a vocal advocate for free trade, said, “Tariffs should not be used as a ‘weapon,’ and balanced trade is beneficial to the world.” His message during Berkshire’s annual meeting reinforced the call for balanced trade as beneficial globally.

Trade Policies and Market Dynamics Influence Outlook

Did you know? Berkshire Hathaway is often viewed as a microcosm of the U.S. economy. Its operational changes, including reactions to tariffs, offer insights into broader economic trends and investor sentiment.

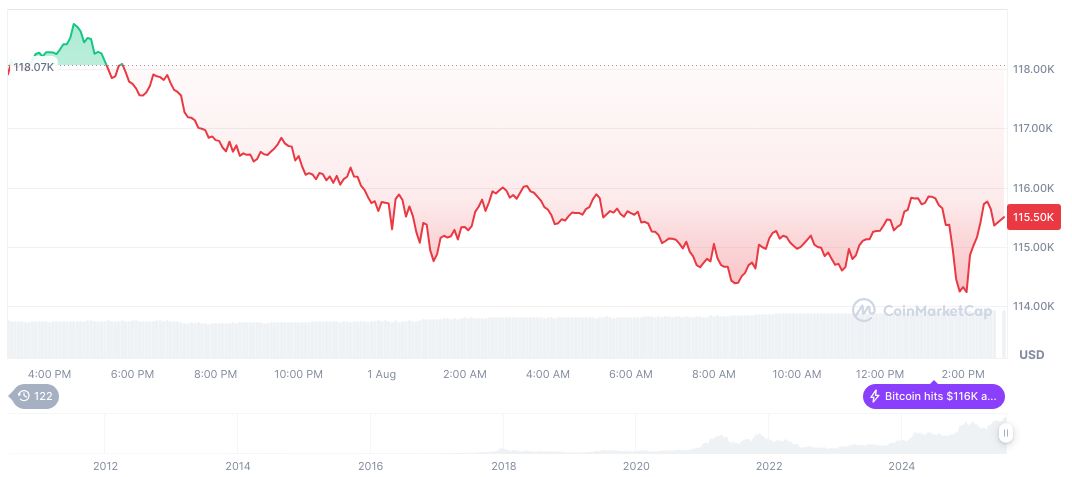

As of August 2, 2025, Bitcoin (BTC) trades at $113,254.10 with a market cap of $2.25 trillion, marking a 2.10% decline over 24 hours. Market dominance remains at 61.37% as reported by CoinMarketCap.

Coincu research suggests that regulatory changes in trade policies could adjust financial forecasts. Historical data indicates that consumer markets are sensitive to tariff shifts, impacting logistics and sales strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/berkshire-hathaway-tariff-impact/