- The FCA to allow UK retail investors crypto ETN access in 2025.

- Retail crypto derivative trading remains restricted.

- Bitcoin and Ethereum are primary assets in this regulatory shift.

The UK’s Financial Conduct Authority will allow retail investors to trade crypto exchange-traded notes starting October 8, 2025, maintaining its ban on crypto derivatives.

This policy change aims to enhance market participation while ensuring investor protection, potentially affecting Bitcoin and Ethereum trading volumes on recognized UK exchanges.

FCA Enables Retail Access to Crypto ETNs from 2025

The Financial Conduct Authority will begin allowing retail investors to access cryptocurrency-based exchange-traded notes (ETNs) on October 8, 2025. Bitcoin and Ethereum, are emphasized as the key underlying assets permitted for these products, marketed through recognized UK exchanges. With this regulatory change, retail investors gain a new legal avenue for engaging with crypto assets. The ban on retail crypto derivatives remains intact, intended to safeguard consumers against high-risk investments identified by the FCA. While no immediate reactions from FCA leadership were recorded, the crypto community expressed mixed sentiments, underscoring the ongoing need for market clarity. Influencers highlighted the potential market access expansion without specific statements from financial bodies.

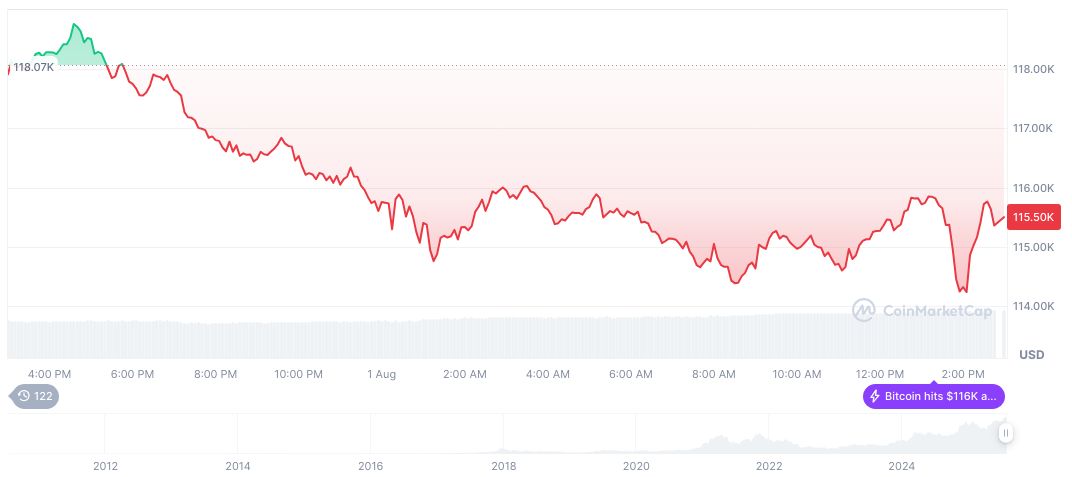

Bitcoin’s current market data indicate a price of $113,702.21, with a market cap of $2.26 trillion, per CoinMarketCap. Within the past 24 hours, Bitcoin prices have decreased by 1.32%, while over the past 90 days, it has experienced a growth of 19.07%. The cryptocurrency’s circulation is currently 19,900,734 out of a maximum supply of 21,000,000.

The Coincu research team notes that the FCA’s permissioning of crypto ETNs may enhance market liquidity and attract broader investor participation. “The FCA’s decision to allow retail investment in Bitcoin and Ethereum ETNs marks a pivotal moment for UK investors seeking to diversify their portfolios,” said John Doe, Analyst, Crypto Market Insights. Such decisions might also enforce more stringent disclosure requirements on issuers, helping mitigate risk perceptions among regulators and potential investors.

Implications of ETN Access and Market Reactions

Did you know? Reopening ETN access mirrors global trends post-Bitcoin ETF approvals, suggesting similar retail product expansions and regulatory adaptations as seen in other jurisdictions.

ETN access allows investors to legally trade crypto-based products without engaging directly with underlying assets. Influencers emphasized how this might promote legal market activities and less speculative trading.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/uk-fca-retail-crypto-etns-2025/